2025 AIOPrice Prediction: Forecasting the Future Market Value and Growth Potential of AIO Technologies

Introduction: AIO's Market Position and Investment Value

OlaXBT (AIO) as an innovative MCP-driven marketplace for crypto trading, has made significant strides since its inception. As of 2025, AIO's market capitalization has reached $35,122,335, with a circulating supply of approximately 230,250,000 tokens, and a price hovering around $0.15254. This asset, hailed as the "AI-powered trading companion," is playing an increasingly crucial role in enhancing cryptocurrency trading with real-time insights and actionable strategies.

This article will comprehensively analyze AIO's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. AIO Price History Review and Current Market Status

AIO Historical Price Evolution

- 2025: Project launch, price fluctuated between $0.06125 and $0.20892

- September 4, 2025: All-time low of $0.06125

- September 18, 2025: All-time high of $0.20892

AIO Current Market Situation

AIO is currently trading at $0.15254, showing a 1.06% increase in the last 24 hours. The token has experienced significant growth over the past month, with a 128.53% price increase. However, it has seen a slight decline of 6.32% in the past week. The current price is 27% below its all-time high and 149% above its all-time low. With a market cap of $35,122,335 and a circulating supply of 230,250,000 AIO, the token ranks 844th in the cryptocurrency market. The 24-hour trading volume stands at $38,766.14, indicating moderate market activity.

Click to view the current AIO market price

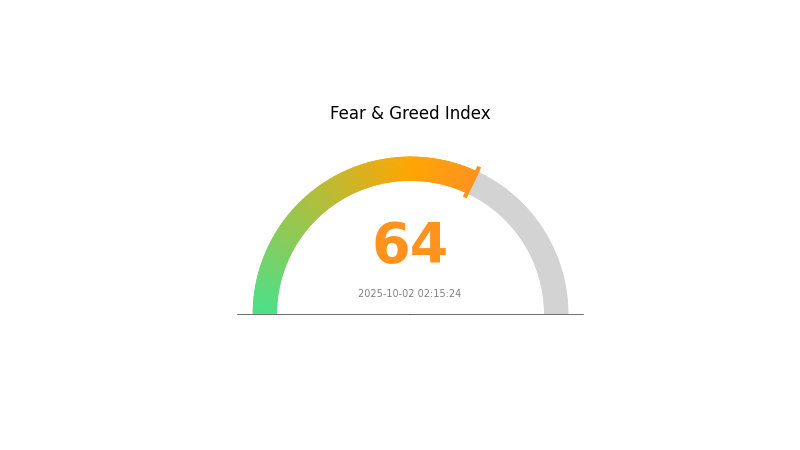

AIO Market Sentiment Indicator

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 64. This suggests that investors are feeling optimistic and may be prone to making emotional decisions. While the positive sentiment can drive prices up, it's essential to remain cautious and avoid FOMO (fear of missing out). Experienced traders on Gate.com often use this indicator as a contrarian signal, considering taking profits or reducing exposure when greed is high. Remember, market sentiment can shift quickly, so always conduct thorough research and manage your risk wisely.

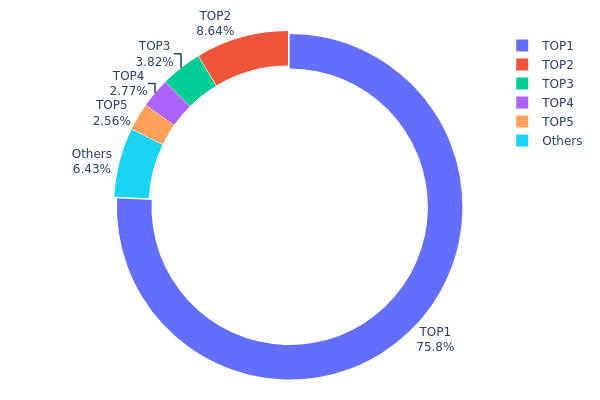

AIO Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for AIO. The top address holds a staggering 75.77% of the total supply, while the top 5 addresses collectively control 93.56% of all tokens. This extreme concentration raises concerns about the token's decentralization and market vulnerability.

Such a concentrated distribution pattern can significantly impact market dynamics. The dominance of a few large holders may lead to increased price volatility and potential market manipulation risks. Any large-scale movement or selling pressure from these top addresses could dramatically affect AIO's market price and liquidity.

This concentration also suggests a low level of token distribution among the broader community, which may hinder widespread adoption and decentralized governance. The current holdings structure indicates a need for improved token distribution mechanisms to enhance market stability and reduce centralization risks in the AIO ecosystem.

Click to view the current AIO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7881...958bb6 | 757743.06K | 75.77% |

| 2 | 0x207d...273f51 | 86437.06K | 8.64% |

| 3 | 0xdf78...a310fb | 38200.00K | 3.82% |

| 4 | 0x3c69...a2521e | 27750.00K | 2.77% |

| 5 | 0x1ab4...8f8f23 | 25601.83K | 2.56% |

| - | Others | 64268.06K | 6.44% |

II. Key Factors Affecting AIO's Future Price

Macroeconomic Environment

- Monetary Policy Impact: As markets are expected to enter an interest rate inflection point in the second half of 2024, this could potentially influence AIO's price.

- Inflation Hedging Properties: With the potential for economic growth acceleration in various sectors, AIO may be viewed as a hedge against inflation.

Technical Development and Ecosystem Building

- AI Innovation: Ongoing AI innovation is driving continued demand, which could positively impact AIO's price.

- Industry Growth: IDC predicts that AI spending by Chinese industrial enterprises will increase significantly, reaching 90 billion RMB by 2028 with a CAGR of 37.7%. This growth in the AI sector could potentially boost AIO's value.

III. AIO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0778 - $0.15254

- Neutral prediction: $0.15254 - $0.18

- Optimistic prediction: $0.18 - $0.19525 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation

- Price range forecast:

- 2027: $0.15083 - $0.23442

- 2028: $0.19975 - $0.2372

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.22264 - $0.27495 (assuming steady market growth)

- Optimistic scenario: $0.27495 - $0.32727 (assuming strong market performance)

- Transformative scenario: $0.32727 - $0.35 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: AIO $0.27495 (potential year-end price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.19525 | 0.15254 | 0.0778 | 0 |

| 2026 | 0.18955 | 0.1739 | 0.09564 | 13 |

| 2027 | 0.23442 | 0.18172 | 0.15083 | 19 |

| 2028 | 0.2372 | 0.20807 | 0.19975 | 36 |

| 2029 | 0.32727 | 0.22264 | 0.13358 | 45 |

| 2030 | 0.2887 | 0.27495 | 0.23921 | 80 |

IV. AIO Professional Investment Strategies and Risk Management

AIO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in AI-driven trading platforms

- Operation suggestions:

- Accumulate AIO tokens during market dips

- Set a target holding period of at least 1-2 years

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor whale activities and KOL sentiment on the OlaXBT platform

- Utilize AI-generated insights for more informed trading decisions

AIO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI-driven projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for AIO

AIO Market Risks

- High volatility: AIO price may experience significant fluctuations

- Market sentiment: AI-driven projects may face shifts in investor interest

- Competition: Emergence of other AI trading platforms could impact AIO's market share

AIO Regulatory Risks

- Uncertain regulations: Potential for stricter oversight of AI-driven trading platforms

- Cross-border compliance: Varying regulatory requirements across different jurisdictions

- Data privacy concerns: Increased scrutiny on AI's use of user data

AIO Technical Risks

- AI performance: Potential for AI algorithms to underperform or make errors

- Platform security: Risk of hacks or technical vulnerabilities

- Scalability issues: Challenges in handling increased user load and transactions

VI. Conclusion and Action Recommendations

AIO Investment Value Assessment

AIO presents a promising long-term value proposition as an innovative AI-driven trading platform. However, investors should be aware of short-term volatility and regulatory uncertainties in the rapidly evolving AI and crypto space.

AIO Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the platform ✅ Experienced investors: Consider a balanced approach, combining long-term holding with active trading ✅ Institutional investors: Explore strategic partnerships and larger positions based on thorough due diligence

AIO Trading Participation Methods

- Gate.com: Purchase AIO tokens directly on the exchange

- OlaXBT platform: Engage with the ecosystem by using AI-driven trading features

- Automated vaults: Participate in AI-managed trading strategies on the platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Aioz reach $5?

Yes, AIOZ has the potential to reach $5 by 2035 based on projected growth, adoption trends, and continued innovation in the network.

Is AIO stock a buy?

Based on long-term indicators, AIO stock has a 24% buy rating, suggesting potential for favorable performance. Consider current market data for the most up-to-date assessment.

Is AIO stock considered a safe investment?

AIO stock has shown mixed performance, with volatility in recent years. While it has outperformed the market at times, past results don't guarantee future safety. Investors should carefully evaluate their risk tolerance.

How high will the AIOZ network go?

AIOZ Network could reach $1.28 in 2025 and $6.85 by 2030, based on current market trends.

Share

Content