2025 QKAPrice Prediction: Analyzing Market Trends and Future Growth Potential for Quantum Key Assets

Introduction: QKA's Market Position and Investment Value

Qkacoin (QKA), as a meme coin inspired by the quokka, has gained attention in the cryptocurrency market since its inception. As of 2025, QKA's market capitalization has reached $43,660,849, with a circulating supply of approximately 31,668,129 tokens and a price hovering around $1.3787. This asset, known as the "quokka-themed meme coin," is playing an increasingly significant role in the meme coin and community-driven token space.

This article will comprehensively analyze QKA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. QKA Price History Review and Current Market Status

QKA Historical Price Evolution

- 2025 April: QKA reached its all-time low of $0.34457

- 2025 July: QKA hit its all-time high of $2.5

- 2025 October: QKA experiencing price volatility, currently trading at $1.3787

QKA Current Market Situation

As of October 1, 2025, QKA is trading at $1.3787, with a 24-hour trading volume of $17,976.75. The token has experienced a significant price decrease of 11.51% in the last 24 hours. However, it's worth noting that QKA has shown positive growth of 6.17% over the past week and month. The current market capitalization stands at $43,660,849.45, ranking QKA at 747th in the overall cryptocurrency market.

QKA's circulating supply is 31,668,129 tokens, which is also its total and maximum supply, indicating that all tokens are in circulation. The fully diluted valuation matches the current market cap, as there are no additional tokens to be released.

Despite the recent 24-hour decline, QKA has shown impressive long-term growth, with a 248.43% increase over the past year. This suggests that while the token is experiencing short-term volatility, it has demonstrated strong performance over a more extended period.

Click to view the current QKA market price

QKA Market Sentiment Indicator

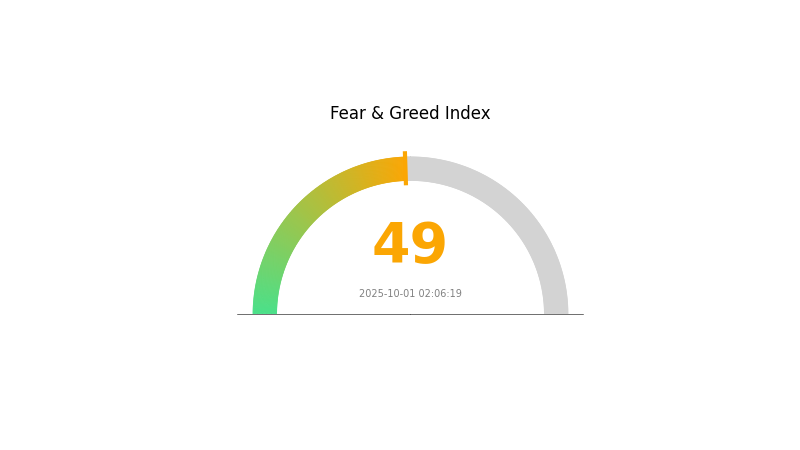

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced as we enter October 2025, with the Fear and Greed Index hovering at 49, indicating a neutral stance. This equilibrium suggests investors are neither overly optimistic nor pessimistic about current market conditions. Traders should remain vigilant, as neutral sentiment often precedes significant market movements. It's an opportune time to reassess portfolios and strategies, considering both potential risks and opportunities in the evolving crypto landscape.

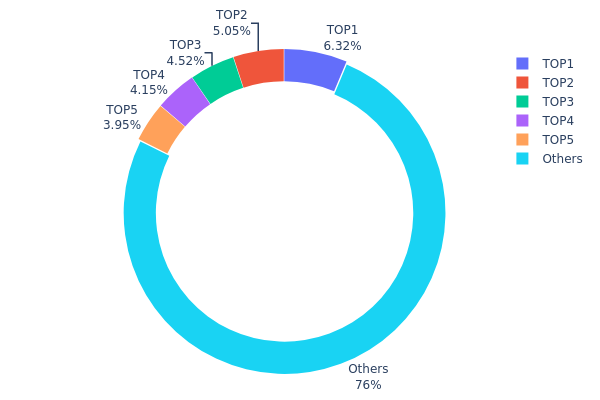

QKA Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of QKA tokens among different wallet addresses. According to the data, the top 5 addresses collectively hold 23.96% of the total QKA supply, with the largest single address controlling 6.31%. This indicates a moderate level of concentration, as no single entity possesses an overwhelmingly large portion of the tokens.

The distribution pattern suggests a relatively balanced market structure, with 76.04% of QKA tokens spread among numerous smaller holders. This decentralization helps mitigate the risk of market manipulation by any single large holder. However, the presence of several addresses holding over 1 million QKA tokens each could still potentially impact short-term price movements if these holders decide to make significant transactions.

Overall, the current QKA address distribution reflects a reasonably healthy balance between larger stakeholders and a diverse base of smaller holders. This structure supports market stability and reduces the likelihood of extreme volatility caused by individual actions, contributing to a more resilient ecosystem for QKA.

Click to view the current QKA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | DRA3dV...rx6Zry | 2000.00K | 6.31% |

| 2 | 9Ukic7...negRSi | 1600.00K | 5.05% |

| 3 | GhZDsp...2P4ENL | 1430.00K | 4.51% |

| 4 | AGXpE4...qEzpEf | 1315.59K | 4.15% |

| 5 | 6WFYLZ...83ym2q | 1250.04K | 3.94% |

| - | Others | 24072.49K | 76.04% |

II. Key Factors Affecting QKA's Future Price

Supply Mechanism

- Market Sentiment: The price of QKA is significantly influenced by market sentiment, as represented by candlestick charts.

- Historical Pattern: Short-term traders tend to rely more on market sentiment, while long-term holders (HODLers) focus on fundamental analysis.

- Current Impact: News announcements and community sentiment have become important price action drivers for QKA.

Institutional and Whale Dynamics

- Corporate Adoption: With the development of blockchain technology, the barrier for individuals and enterprises to issue cryptocurrencies has been lowered, potentially impacting QKA's adoption and price.

Macroeconomic Environment

- Inflation Hedging Properties: The upward trend in prices may be affected by various economic factors, including inflation.

- Geopolitical Factors: International situations, such as trade frictions, can impact supply chains and, consequently, the price of assets like QKA.

Technological Development and Ecosystem Building

- Blockchain Technology Advancement: The ongoing development of blockchain technology is a key factor influencing the future trends of cryptocurrencies like QKA.

- Ecosystem Applications: Future developments in areas such as autonomous driving and intelligent cockpits may indirectly affect the ecosystem and value of cryptocurrencies.

III. QKA Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $1.19 - $1.30

- Neutral estimate: $1.30 - $1.50

- Optimistic estimate: $1.50 - $1.75 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $1.28 - $2.02

- 2028: $1.47 - $2.29

- Key catalysts: Increased adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $2.08 - $2.32 (assuming steady market growth)

- Optimistic scenario: $2.56 - $3.00 (with strong market performance)

- Transformative scenario: $3.00 - $3.30 (with exceptional market conditions)

- 2030-12-31: QKA $3.29767 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.7512 | 1.3789 | 1.19964 | 0 |

| 2026 | 1.86241 | 1.56505 | 1.03293 | 13 |

| 2027 | 2.0222 | 1.71373 | 1.2853 | 24 |

| 2028 | 2.2976 | 1.86797 | 1.47569 | 35 |

| 2029 | 2.56182 | 2.08278 | 1.08305 | 51 |

| 2030 | 3.29767 | 2.3223 | 2.1133 | 68 |

IV. QKA Professional Investment Strategies and Risk Management

QKA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors interested in meme coins

- Operation suggestions:

- Accumulate QKA during price dips

- Set a long-term price target and stick to it

- Store QKA in a secure wallet, preferably a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Pay attention to social media sentiment and meme trends

- Set strict stop-loss and take-profit levels

QKA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different meme coins and crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Hot wallet solution: Use reputable software wallets with strong security features

- Security precautions: Enable two-factor authentication, use unique passwords, and regularly update software

V. Potential Risks and Challenges for QKA

QKA Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Sentiment-driven: Price heavily influenced by social media trends and influencer opinions

- Limited utility: Lack of real-world use cases may impact long-term value

QKA Regulatory Risks

- Regulatory crackdowns: Increased scrutiny of meme coins by financial authorities

- Market manipulation concerns: Potential for pump-and-dump schemes

- Listing uncertainties: Risk of delisting from exchanges due to regulatory pressures

QKA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Solana network issues could affect transaction speed and costs

- Limited development team: Uncertainty about ongoing technical support and updates

VI. Conclusion and Action Recommendations

QKA Investment Value Assessment

QKA presents a high-risk, high-reward opportunity in the meme coin space. While it has shown significant price appreciation, its long-term value proposition remains uncertain due to limited utility and regulatory concerns.

QKA Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio, if any ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Approach with caution, focus on short-term momentum trades

QKA Trading Participation Methods

- Spot trading: Buy and sell QKA on Gate.com's spot market

- Limit orders: Set target entry and exit prices to manage risk

- DCA strategy: Consider dollar-cost averaging for long-term accumulation

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for quantum coin in 2025?

Based on market analysis, Quantum Coin's price in 2025 is predicted to be between $0.000002 and $0.000004, showing potential for growth.

What is the XRP price prediction in 2025?

Based on current trends, XRP is predicted to reach around $1.50 to $2.00 by the end of 2025, with potential for higher peaks during bull markets.

What is the price prediction for QS in 2025?

QS price is predicted to reach $50-$60 by 2025, driven by advancements in solid-state battery technology and increased adoption in the EV market.

What crypto has the highest price prediction?

Bitcoin is expected to have the highest price prediction in 2025, followed by Ethereum. These two cryptocurrencies are projected to maintain their market dominance and value leadership.

Share

Content