Gate Research: Thoughts on Exodus Issuing Tokenized Stocks On-Chain

7/31/2025, 9:11:46 AM

Download the Full Report (PDF)

Gate Research Institute recently published "Thoughts on Exodus Issuing Tokenized Stocks On-Chain", providing an in-depth analysis of Exodus' innovative practice of issuing tokenized stocks on-chain. The report explores multiple dimensions including technology, regulation, and market. Exodus utilized the high performance and convenient asset creation mechanism of the Algorand blockchain to successfully tokenize its stocks. In December 2024, Exodus received SEC approval to transfer to the NYSE, significantly improving asset liquidity. The report points out that the explosion of stock tokenization narrative in 2025 benefited from the promotion of crypto-friendly policies in the US. Non-crypto industry listed companies may have the opportunity to attract global capital through tokenized financing. The Exodus case not only verifies the feasibility of technology and regulation but also reveals the huge potential for listed companies to raise funds through on-chain additional issuance, paving a new path for the inteAbstract

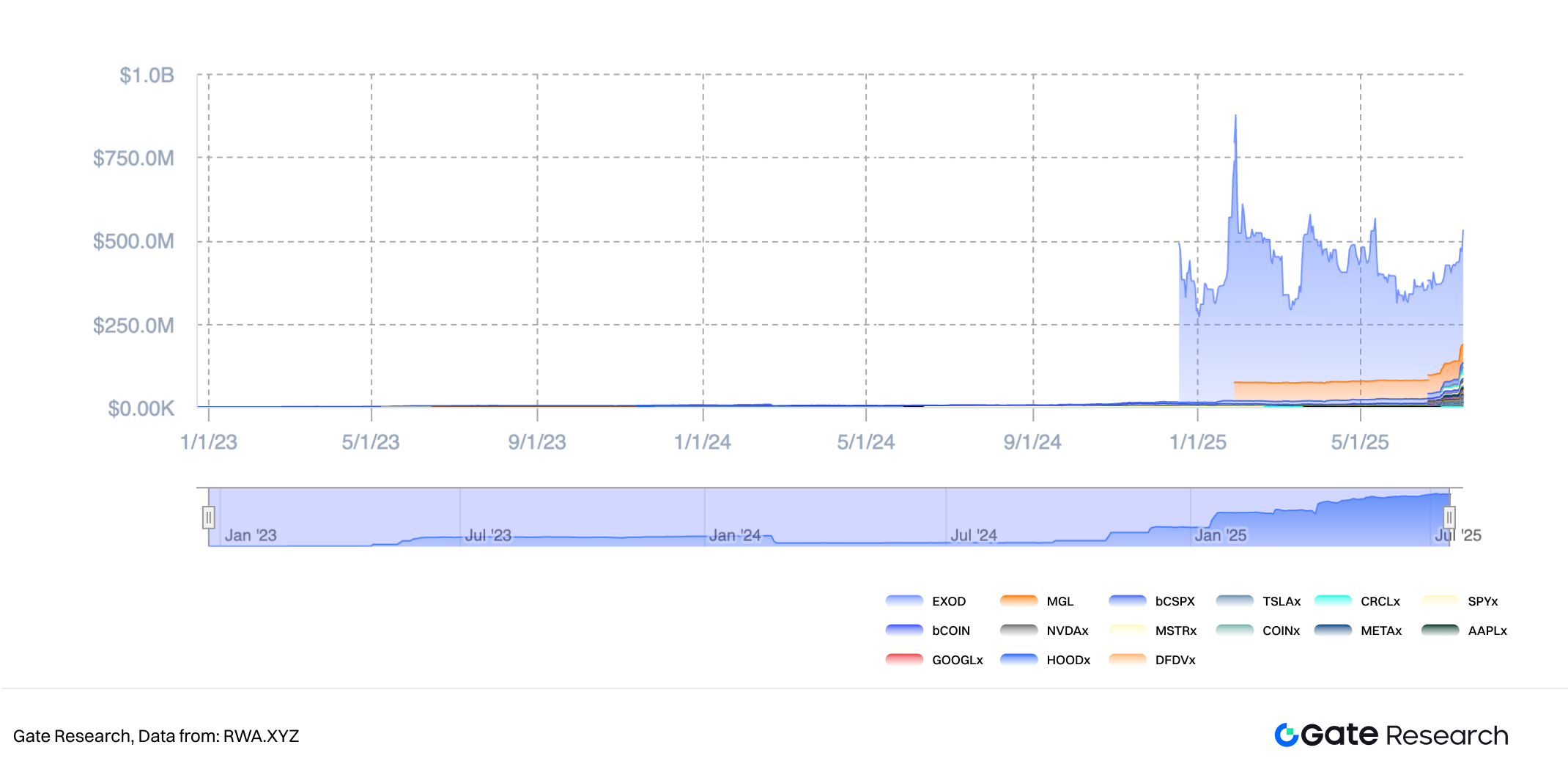

- Event Review: Stock tokenization became a market hotspot in the second half of 2025, with Robinhood and xStocks driving a surge in trading volume and narrative heat. Exodus received SEC approval in December 2024 to transfer from the OTC market to the NYSE, significantly improving the liquidity of its tokenized stocks through the Algorand blockchain. In December 2024, the market size of tokenized stocks jumped from $5 million to over $200 million.

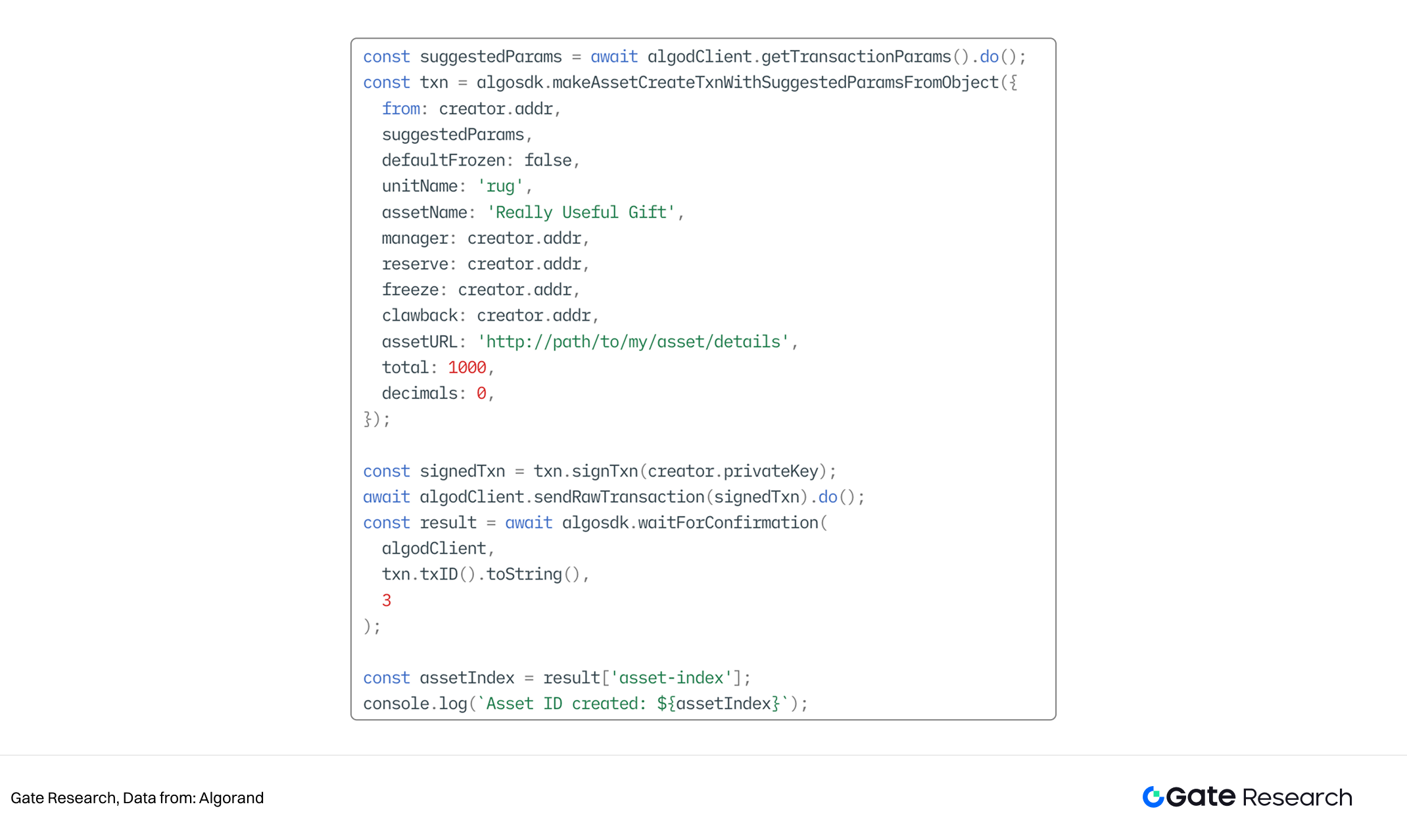

- Technical implementation: Exodus chose the Algorand blockchain to issue tokenized stocks, leveraging its advantage of over 6,000 transactions per second and less than 5 seconds latency to ensure efficient circulation. Algorand doesn’t require complex smart contracts; standard assets can be created with just key parameters, simplifying the deployment process. The Goal command set further reduces code complexity, quickly completing asset on-chain deployment and saving development time. Tools like JavaScript SDK provide diverse deployment methods, enhancing the convenience of on-chain asset management.

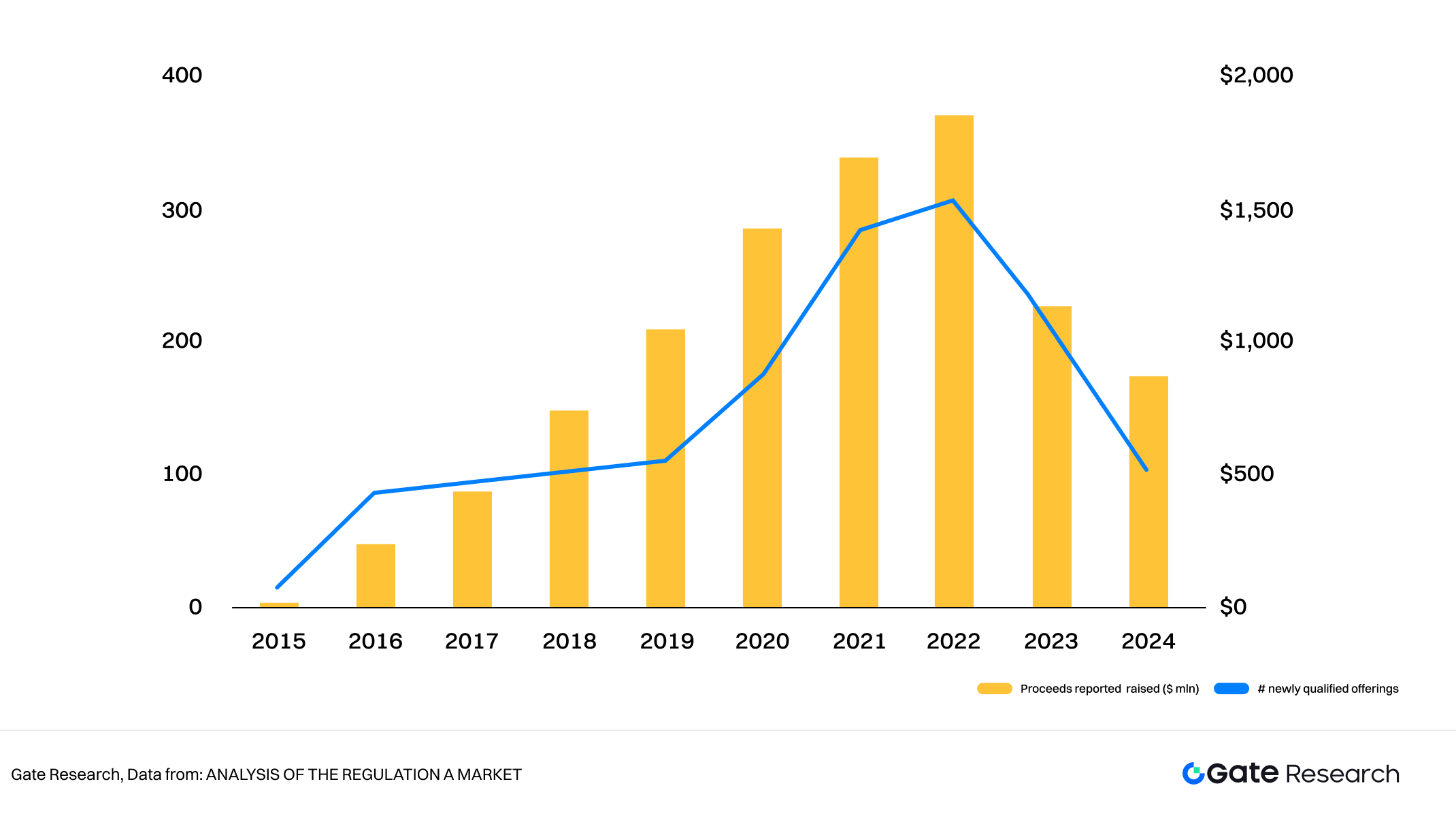

- Policy and regulation: Exodus completed tokenized financing through Regulation A exemption, but this mechanism is relatively inefficient. Only 33% of target funding was achieved between 2015-2024, with funding amounts dropping below $1 billion in 2024. US crypto-friendly policies and the regulatory sandbox promoted by the Trump administration provide new opportunities for stock tokenization. SEC crypto team leader Hester Peirce proposed establishing a regulatory sandbox, allowing companies to innovate in a controlled environment and supporting listed companies to issue tokenized securities on-chain.

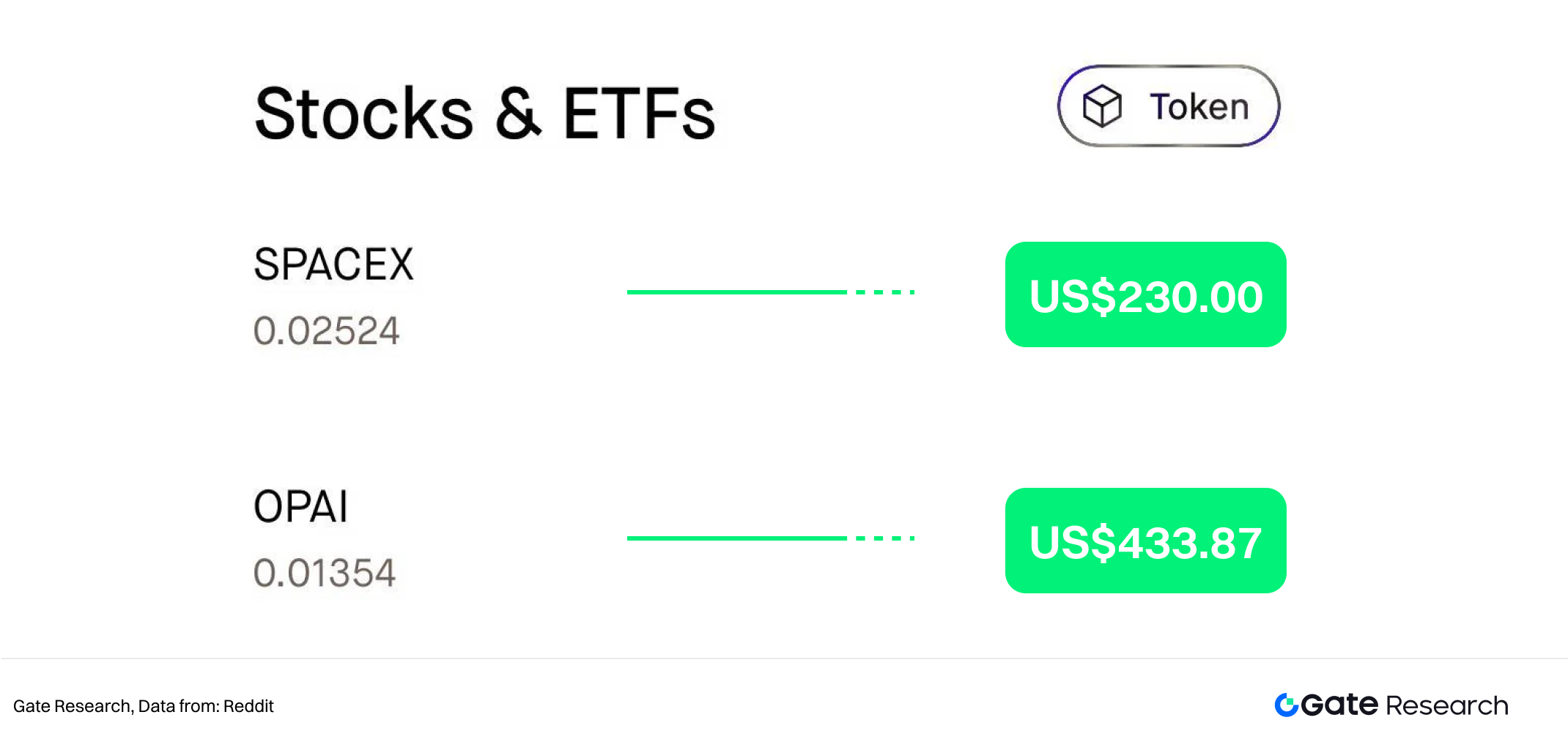

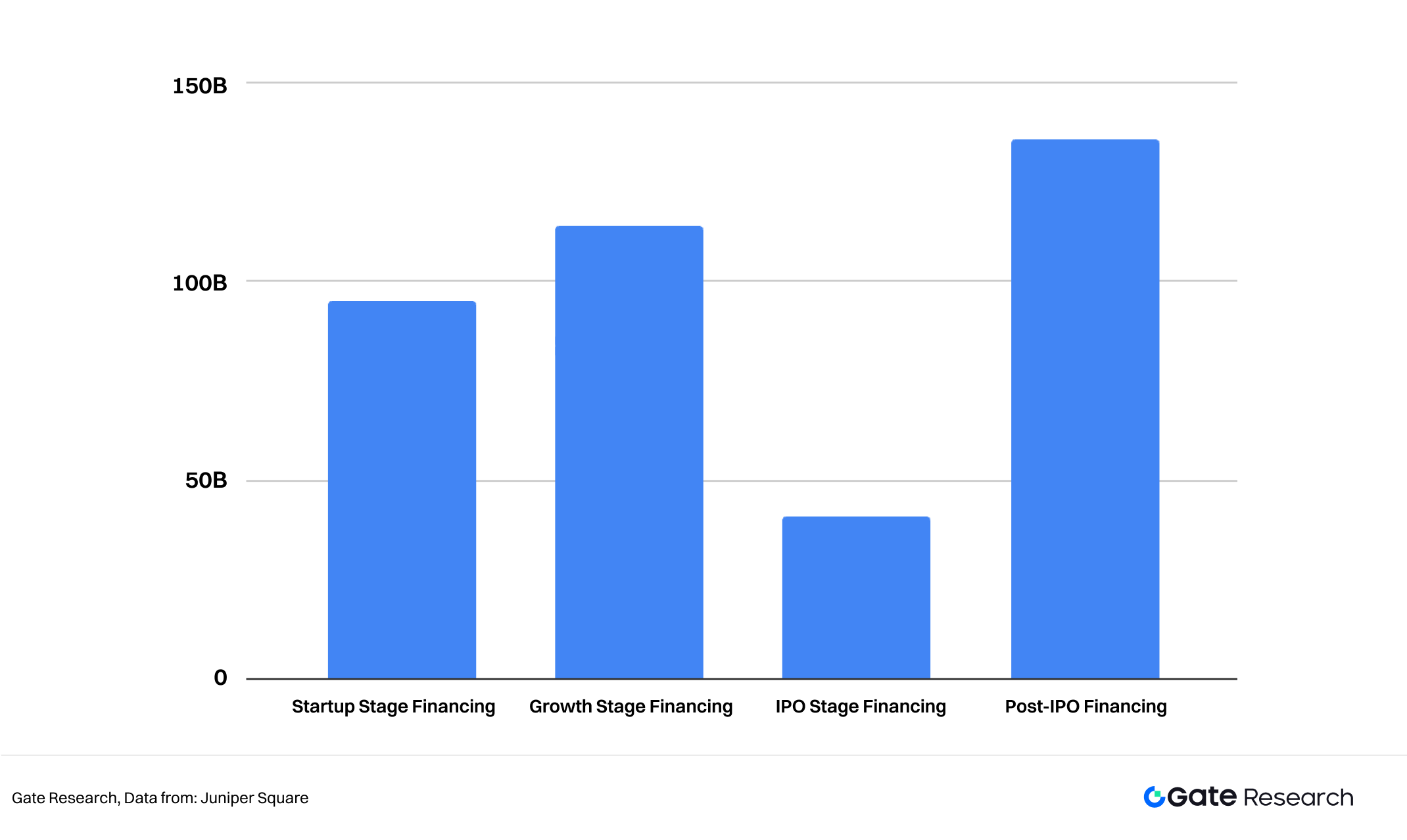

- Share tokenization: Tokenized financing spans various stages from startup to IPO, with the Exodus case demonstrating the feasibility of IPO tokenization. US crypto-friendly policies in 2024 promoted large-scale applications in this field. Early-stage companies like Quadrant Biosciences raised over $13 million through tokenized equity. From Series C to Pre-IPO stages, Robinhood unauthorized tokenization of unicorn company stocks like SpaceX may lead to valuation fluctuations. IPO tokenization requires SEC approval; Exodus completed the process with Securitize’s assistance. Platforms like Backed Asset tokenize stocks of companies like Tesla through SPVs, with stock tokens circulating on the Solana chain, but price de-pegging may increase the risk of stock price volatility for listed companies.

- Future Trends: US crypto policy openness drives the development of stock tokenization. Listed companies may supplement liquidity through on-chain additional issuance of stocks or convertible bonds, supporting business expansion and acquisitions. In 2024, US stock refinancing reached $135.9 billion, far exceeding the $40.7 billion in IPOs, indicating huge market potential. Investors can subscribe to tokenized stocks at discounted prices and stake them on DeFi platforms for interest, attracting long-term investors. Crypto M&A transactions surged in 2025, such as Coinbase’s $2.9 billion acquisition of Deribit, and tokenized financing may facilitate industry consolidation.

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Author: Mark

Reviewer(s): Ember、Shirley

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Related Articles

Beginner

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

DEX aggregators integrate order data, price information, and liquidity pools from multiple decentralized exchanges, helping users find the optimal trading path in the shortest time. This article delves into 8 commonly used DEX aggregators, highlighting their unique features and routing algorithms.

10/21/2024, 11:44:22 AM

Beginner

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

This article explores the development trends, applications, and prospects of cross-chain bridges.

12/27/2023, 7:44:05 AM

Advanced

Solana Need L2s And Appchains?

Solana faces both opportunities and challenges in its development. Recently, severe network congestion has led to a high transaction failure rate and increased fees. Consequently, some have suggested using Layer 2 and appchain technologies to address this issue. This article explores the feasibility of this strategy.

6/24/2024, 1:39:17 AM

Intermediate

Sui: How are users leveraging its speed, security, & scalability?

Sui is a PoS L1 blockchain with a novel architecture whose object-centric model enables parallelization of transactions through verifier level scaling. In this research paper the unique features of the Sui blockchain will be introduced, the economic prospects of SUI tokens will be presented, and it will be explained how investors can learn about which dApps are driving the use of the chain through the Sui application campaign.

8/13/2025, 7:33:39 AM

Beginner

What Is Copy Trading And How To Use It?

Copy Trading, as the most profitable trading model, not only saves time but also effectively reduces losses and avoids man-made oversights.

11/10/2023, 7:15:23 AM

Beginner

How to Do Your Own Research (DYOR)?

"Research means that you don’t know, but are willing to find out."

- Charles F. Kettering.

12/15/2022, 9:56:17 AM

Start Now

Sign up and get a

$100

Voucher!