2025 BTRST Price Prediction: Analyzing Market Trends and Future Growth Potential of the Braintrust Token

Introduction: BTRST's Market Position and Investment Value

Braintrust (BTRST), as a decentralized talent network token, has been connecting freelancers with organizations since its inception in 2021. As of 2025, BTRST's market capitalization has reached $40,474,023, with a circulating supply of approximately 241,347,782 tokens, maintaining a price around $0.1677. This asset, often referred to as the "decentralized LinkedIn," is playing an increasingly crucial role in the gig economy and talent management sectors.

This article will provide a comprehensive analysis of BTRST's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BTRST Price History Review and Current Market Status

BTRST Historical Price Evolution

- 2021: Initial launch, price peaked at $46.82 on September 16

- 2021: Market correction, price dropped to its all-time low of $0.16 on October 19

- 2025: Ongoing market cycle, price fluctuating between historical high and low points

BTRST Current Market Situation

As of October 1, 2025, BTRST is trading at $0.1677. The token has experienced a 0.96% increase in the last 24 hours, with a trading volume of $21,366.02. BTRST's market capitalization stands at $40,474,023, ranking it 779th in the cryptocurrency market. The circulating supply is 241,347,782 BTRST, which represents 96.54% of the total supply of 250,000,000 tokens.

Over the past week, BTRST has seen a decline of 9.36%, while the 30-day performance shows a more significant drop of 15.31%. The year-to-date performance indicates a substantial decrease of 55.82%, reflecting the broader market trends and specific challenges faced by the project.

The current price is significantly lower than its all-time high of $46.82, recorded on September 16, 2021, representing a 99.64% decrease from its peak. This substantial decline highlights the volatility and potential risks associated with the cryptocurrency market.

Click to view the current BTRST market price

BTRST Market Sentiment Indicator

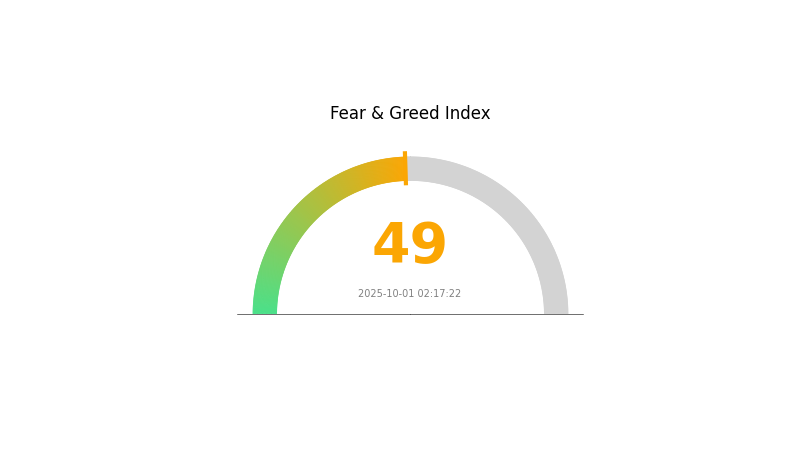

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment for BTRST remains balanced as the Fear and Greed Index stands at 49, indicating a neutral position. This suggests that investors are neither overly fearful nor excessively greedy, maintaining a cautious yet optimistic outlook. Traders should stay vigilant and consider diversifying their portfolios to mitigate potential risks. As always, it's crucial to conduct thorough research and exercise prudence when making investment decisions in the volatile crypto market.

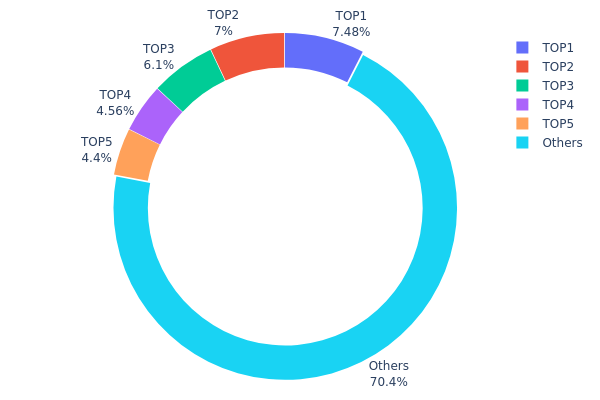

BTRST Holdings Distribution

The address holdings distribution data for BTRST reveals a moderate level of concentration among the top holders. The top 5 addresses collectively control 29.53% of the total supply, with individual holdings ranging from 4.40% to 7.48%. This distribution suggests a relatively balanced ownership structure, where no single address holds an overwhelming majority of tokens.

However, the presence of several large holders with significant stakes could potentially influence market dynamics. The top address, controlling 7.48% of the supply, has the capacity to impact prices if large transactions are executed. Nonetheless, with 70.47% of tokens distributed among other addresses, BTRST demonstrates a reasonable level of decentralization, which may contribute to market stability and reduce the risk of price manipulation by a single entity.

This distribution pattern indicates a maturing market structure for BTRST, balancing between concentrated institutional or early investor holdings and wider retail participation. While not entirely immune to large holder influence, the current distribution suggests a moderately robust on-chain structure that could support long-term stability and organic price discovery mechanisms.

Click to view the current BTRST Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb6f1...33990b | 18712.45K | 7.48% |

| 2 | 0xe754...87600a | 17499.99K | 6.99% |

| 3 | 0x0768...b88627 | 15250.00K | 6.10% |

| 4 | 0xd20d...b0dd6e | 11411.81K | 4.56% |

| 5 | 0x3154...0f2c35 | 11010.79K | 4.40% |

| - | Others | 176114.97K | 70.47% |

II. Key Factors Affecting BTRST's Future Price

Supply Mechanism

- Historical patterns: The price of BTRST was close to $30 in September 2021. By September 2022, the token price had dropped to $2.40.

Institutional and Whale Dynamics

- Corporate adoption: Braintrust has attracted various enterprises to its platform, with the token BTRST being used to drive platform growth.

Macroeconomic Environment

- Inflation hedging properties: BTRST is decoupled from the broader cryptocurrency market, potentially reducing its volatility in inflationary environments.

- Geopolitical factors: Economic recession risks could impact BTRST's price. A severe recession would likely have negative effects on the token's value.

Technical Development and Ecosystem Building

- Ecosystem applications: Braintrust operates as a decentralized talent network, connecting freelancers (talent) with clients (enterprises) through its platform.

- Platform mechanics: Payments between talent and enterprises are settled in local fiat currencies to avoid income fluctuations due to token price volatility. The platform maintains a 10% cash commission rate, using BTRST tokens to substitute for customer acquisition costs.

III. BTRST Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.10397 - $0.1677

- Neutral forecast: $0.1677 - $0.20627

- Optimistic forecast: $0.20627 - $0.24 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2027: $0.1765 - $0.24483

- 2028: $0.11083 - $0.24121

- Key catalysts: Technological advancements, wider industry partnerships, and potential market recovery

2030 Long-term Outlook

- Base scenario: $0.23832 - $0.2648 (assuming steady market growth and adoption)

- Optimistic scenario: $0.2648 - $0.37601 (assuming strong market performance and increased utility)

- Transformative scenario: $0.37601 - $0.45 (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: BTRST $0.37601 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.20627 | 0.1677 | 0.10397 | 0 |

| 2026 | 0.1926 | 0.18699 | 0.14585 | 11 |

| 2027 | 0.24483 | 0.18979 | 0.1765 | 13 |

| 2028 | 0.24121 | 0.21731 | 0.11083 | 29 |

| 2029 | 0.30033 | 0.22926 | 0.14673 | 36 |

| 2030 | 0.37601 | 0.2648 | 0.23832 | 57 |

IV. BTRST Professional Investment Strategies and Risk Management

BTRST Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in decentralized talent networks

- Operation suggestions:

- Accumulate BTRST during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set stop-loss orders to manage downside risk

BTRST Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BTRST

BTRST Market Risks

- High volatility: BTRST price may experience significant fluctuations

- Limited liquidity: Low trading volume may lead to price slippage

- Competition: Other decentralized talent platforms may emerge

BTRST Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting token utility

- Cross-border compliance: Challenges in adhering to various international regulations

- Tax implications: Evolving tax laws may impact BTRST holders

BTRST Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Network congestion on Ethereum may affect BTRST transactions

- Dependency on Ethereum: BTRST is subject to Ethereum's technical limitations and upgrades

VI. Conclusion and Action Recommendations

BTRST Investment Value Assessment

BTRST offers exposure to the growing decentralized talent network market but faces significant volatility and adoption challenges. Long-term potential exists if Braintrust gains traction, but short-term risks remain high.

BTRST Investment Recommendations

✅ Beginners: Consider small, exploratory positions with a long-term outlook ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

BTRST Participation Methods

- Spot trading: Purchase BTRST on Gate.com

- Staking: Participate in governance and earn rewards if available

- Network participation: Use the Braintrust platform to understand token utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is 1 btrst?

As of 2025-10-01, 1 BTRST is worth $0.1939. This price is subject to market fluctuations.

What is the btrst coin?

BTRST is an Ethereum token for Braintrust, a decentralized talent network. It powers the platform, connecting freelancers with organizations.

What is the BT share price prediction for 2030?

Based on current market analysis, BT Group stock is predicted to reach an average price of $6.5658 in 2030, with a potential high of $7.963.

What crypto has the highest price prediction?

Bitcoin is expected to have the highest price prediction in 2025, followed by Ethereum. These two cryptocurrencies are projected to maintain their market dominance and value growth.

Share

Content