2025 CUSD Price Prediction: Future Trends and Market Analysis for the Stablecoin Economy

Introduction: CUSD's Market Position and Investment Value

Celo Dollar (CUSD) as a stablecoin pegged to the US dollar, has been playing an increasingly crucial role in the decentralized finance ecosystem since its inception. As of 2025, CUSD's market capitalization has reached $35,521,468, with a circulating supply of approximately 35,553,466 tokens, maintaining a price around $0.9991. This asset, often referred to as a "flexible supply stablecoin," is playing an increasingly vital role in facilitating faster, cheaper, and more convenient fund sharing within the Celo ecosystem.

This article will provide a comprehensive analysis of CUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CUSD Price History Review and Current Market Status

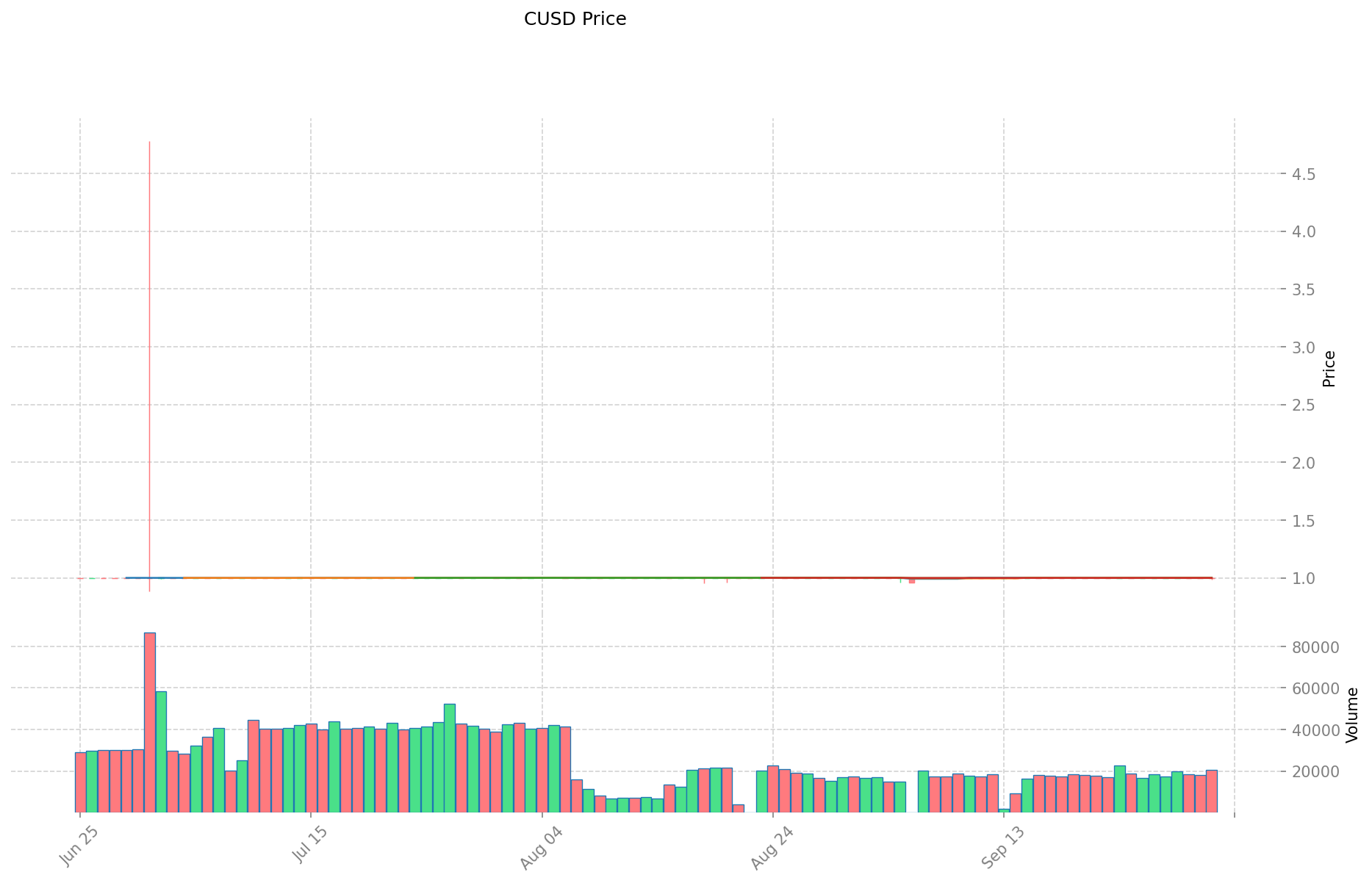

CUSD Historical Price Evolution

- 2021: CUSD reached its all-time high of $1.14 on September 10, marking a significant milestone in its price history.

- 2023: The cryptocurrency experienced its all-time low of $0.886584 on March 11, demonstrating the volatility of the stablecoin market.

- 2025: CUSD has shown relative stability, maintaining a price close to its $1 peg throughout the year.

CUSD Current Market Situation

As of October 2, 2025, CUSD is trading at $0.9991, showing a slight deviation from its intended $1 peg. The 24-hour trading volume stands at $20,618.53, indicating moderate market activity. The total market capitalization is $35,521,468.06, ranking CUSD at 841st position in the global cryptocurrency market.

The current circulating supply of CUSD is 35,553,466.18, which is very close to its total supply of 35,553,967.18. This suggests that almost all of the minted CUSD is in circulation. The fully diluted market cap is significantly higher at $999,100,000,000,000, based on the maximum supply of 1,000,000,000,000,000 CUSD.

Over the past 24 hours, CUSD has experienced a slight decrease of 0.02% in its value. The price has ranged between a low of $0.9858 and a high of $1.001, demonstrating the stablecoin's ability to maintain relative stability despite minor fluctuations.

Click to view the current CUSD market price

CUSD Market Sentiment Indicator

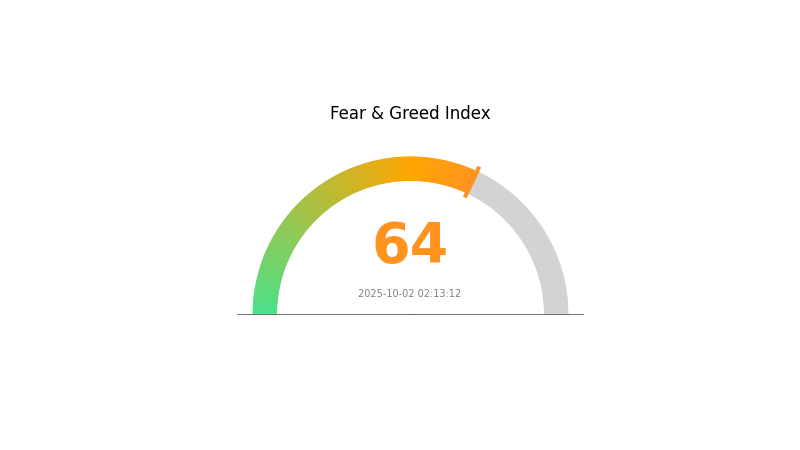

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently showing signs of greed, with the Fear and Greed Index at 64. This indicates that investors are becoming increasingly optimistic about the market's prospects. However, it's important to remember that excessive greed can lead to overvaluation and potential market corrections. Traders should remain cautious and consider diversifying their portfolios to mitigate risks. As always, conducting thorough research and staying informed about market trends is crucial for making sound investment decisions in the volatile crypto space.

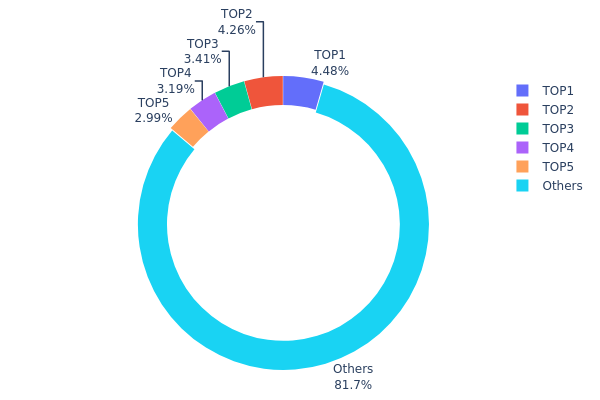

CUSD Holdings Distribution

The address holdings distribution data provides insights into the concentration of CUSD tokens among different wallet addresses. Analysis of this data reveals a relatively decentralized distribution pattern for CUSD. The top 5 addresses collectively hold 18.3% of the total supply, with the largest individual holder possessing 4.48% of tokens. This distribution suggests a healthy level of decentralization, as no single entity has an overwhelming concentration of tokens.

The majority of CUSD tokens (81.7%) are distributed among numerous smaller holders, indicating a broad base of users or investors. This widespread distribution can contribute to market stability and reduce the risk of price manipulation by large holders. However, it's worth noting that the top holders still have significant positions, which could potentially influence market dynamics if they were to make large transactions.

Overall, the current CUSD holdings distribution reflects a balanced ecosystem with a good degree of decentralization. This structure typically supports market resilience and aligns with the principles of distributed networks, potentially fostering long-term stability and user confidence in the CUSD token.

Click to view the current CUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xCA31...311270 | 750.00K | 4.48% |

| 2 | 0xF424...26725E | 713.17K | 4.26% |

| 3 | 0x5dC6...3d249f | 570.08K | 3.40% |

| 4 | 0xD3D2...2137E1 | 533.34K | 3.18% |

| 5 | 0x9C25...e22412 | 500.00K | 2.98% |

| - | Others | 13665.23K | 81.7% |

II. Key Factors Affecting Future CUSD Price

Supply Mechanism

- Redistribution Mechanism: Protocols like Cap have implemented redistribution functions, where funds from reduced operators are redistributed to affected cUSD holders.

- Current Impact: The redistribution mechanism can influence CUSD price by adjusting supply distribution among holders.

Institutional and Whale Dynamics

- Corporate Adoption: Adoption of CUSD by notable enterprises can significantly impact its price and market perception.

Macroeconomic Environment

- Inflation Hedging Properties: CUSD's performance in inflationary environments may affect its attractiveness as a store of value.

- Geopolitical Factors: International situations and policy changes can influence CUSD's global adoption and value.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects utilizing CUSD can drive demand and price.

III. CUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.77922 - $0.90

- Neutral prediction: $0.90 - $1.10

- Optimistic prediction: $1.10 - $1.34865 (requires significant market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $1.01542 - $1.9752

- 2028: $1.12767 - $1.98604

- Key catalysts: Wider adoption of stablecoins, regulatory clarity, and integration with traditional finance systems

2029-2030 Long-term Outlook

- Base scenario: $1.83457 - $1.95381 (assuming steady growth and adoption)

- Optimistic scenario: $2.07306 - $2.83303 (assuming rapid expansion and mainstream acceptance)

- Transformative scenario: $3.00 - $3.50 (assuming revolutionary breakthroughs in blockchain technology and global economic shifts)

- 2030-12-31: CUSD $1.95381 (95% growth from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.34865 | 0.999 | 0.77922 | 0 |

| 2026 | 1.60814 | 1.17383 | 0.59865 | 17 |

| 2027 | 1.9752 | 1.39098 | 1.01542 | 39 |

| 2028 | 1.98604 | 1.68309 | 1.12767 | 68 |

| 2029 | 2.07306 | 1.83457 | 1.66946 | 83 |

| 2030 | 2.83303 | 1.95381 | 1.83659 | 95 |

IV. Professional Investment Strategies and Risk Management for CUSD

CUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Accumulate CUSD during market dips

- Set up regular purchase plans

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor CUSD/USD peg stability

- Track Celo ecosystem developments

CUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Allocate across different stablecoins

- Collateral monitoring: Track Celo reserve stability

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable 2FA, use strong passwords, regular security audits

V. Potential Risks and Challenges for CUSD

CUSD Market Risks

- Depegging: Risk of CUSD losing its 1:1 peg with USD

- Liquidity: Potential liquidity issues in extreme market conditions

- Competition: Increasing competition from other stablecoins

CUSD Regulatory Risks

- Stablecoin regulations: Potential new regulations affecting CUSD

- Cross-border restrictions: Possible limitations on international transfers

- Tax implications: Evolving tax treatments for stablecoin transactions

CUSD Technical Risks

- Smart contract vulnerabilities: Potential exploits in the CUSD contract

- Blockchain congestion: Celo network scalability challenges

- Oracle failures: Risks associated with price feed inaccuracies

VI. Conclusion and Action Recommendations

CUSD Investment Value Assessment

CUSD offers a stable store of value within the Celo ecosystem, with potential for increased adoption. However, investors should remain vigilant of regulatory and technical risks.

CUSD Investment Recommendations

✅ Beginners: Start with small allocations to understand CUSD's role in the Celo ecosystem

✅ Experienced investors: Consider CUSD for portfolio diversification and as a gateway to Celo DeFi

✅ Institutional investors: Evaluate CUSD for treasury management and as a potential USD-pegged digital asset

CUSD Participation Methods

- Direct purchase: Buy CUSD on Gate.com

- Celo ecosystem participation: Use CUSD in Celo-based DeFi applications

- Yield farming: Explore CUSD liquidity provision opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is cusd currency?

CUSD is a stablecoin pegged to the US dollar, issued by Celo. It maintains price stability and is used in decentralized finance applications on the Celo network.

What is XRP crypto price prediction 2030?

XRP could reach $473,000 by 2030 if 10% of global assets are tokenized, based on analyst projections.

What is the price prediction for USDC in 2030?

Based on current projections, USDC could reach $1.65 by 2030, assuming a 5% price change. This forecast is speculative and subject to market conditions.

What is the prediction for illuvium in 2025?

Based on current market analysis, Illuvium is predicted to trade between $13.14 and $13.51 by December 2025.

Share

Content