2025 ICEPrice Prediction: Evaluating Market Trends and Regulatory Impacts on Intercontinental Exchange's Future Performance

Introduction: ICE's Market Position and Investment Value

Ice Open Network (ICE), as a Layer 1 blockchain revolutionizing Web3 interactions, has made significant strides since its inception in 2023. As of 2025, ICE's market capitalization has reached $37,774,649, with a circulating supply of approximately 6,792,780,005 tokens, and a price hovering around $0.005561. This asset, hailed as the "Web3 Empowerment Token," is playing an increasingly crucial role in decentralized services, including digital identity verification, social media interaction, and secure data storage.

This article will comprehensively analyze ICE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ICE Price History Review and Current Market Status

ICE Historical Price Evolution Trajectory

- 2024: ICE reached its all-time high of $0.15 on January 19, marking a significant milestone in its price history.

- 2024: The market experienced a downturn, with ICE hitting its all-time low of $0.002725 on August 5.

- 2025: The market has shown signs of recovery, with ICE price fluctuating and currently stabilizing around $0.005561.

ICE Current Market Situation

As of October 2, 2025, ICE is trading at $0.005561, with a 24-hour trading volume of $845,206.45. The token has experienced a 2.52% decrease in the last 24 hours. ICE's market capitalization stands at $37,774,649.61, ranking it 813th in the global cryptocurrency market. The circulating supply is 6,792,780,005.41 ICE, which represents 32.12% of the total supply of 21,150,537,435.26 ICE. Over the past week, ICE has shown positive momentum with an 11.42% increase, while its 30-day performance is even more impressive at 26.85% growth. However, the yearly performance shows a 19.23% decline, indicating long-term volatility.

Click to view the current ICE market price

ICE Market Sentiment Indicator

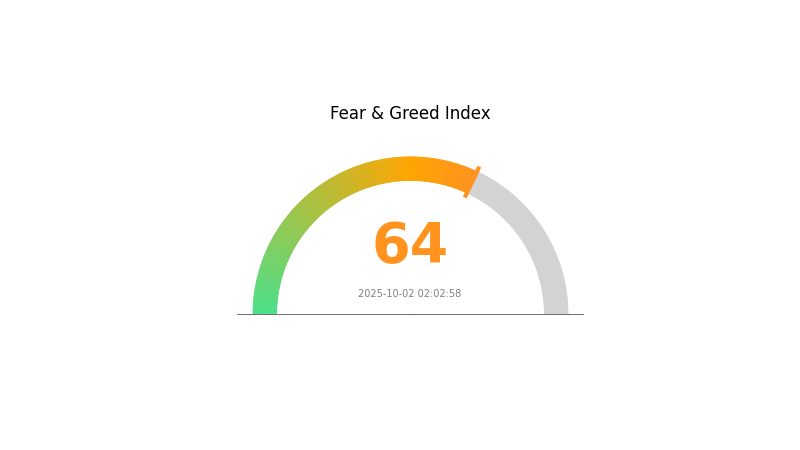

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of optimism as the Fear and Greed Index reaches 64, indicating a state of greed. This suggests that investors are becoming increasingly confident and bullish. However, it's important to remember that extreme greed can sometimes lead to market corrections. Traders should remain cautious and consider taking profits or rebalancing their portfolios. As always, it's crucial to conduct thorough research and manage risk effectively in this volatile market environment.

ICE Holdings Distribution

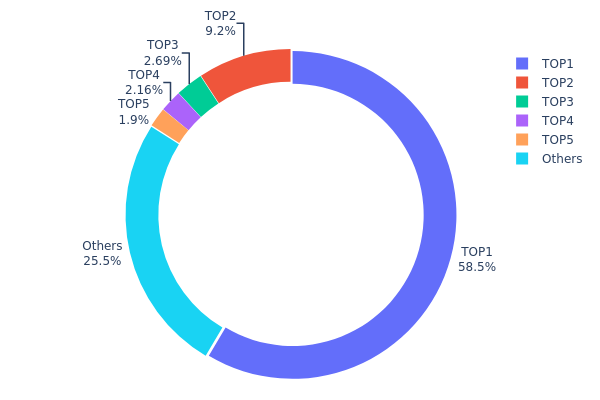

The address holdings distribution data for ICE reveals a highly concentrated ownership structure. The top address holds a staggering 58.53% of the total supply, indicating significant centralization. The second-largest holder accounts for 9.20%, while the remaining top 5 addresses collectively control about 6.74% of the supply. This leaves only 25.53% distributed among all other addresses.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. The dominant address could exert substantial influence over the token's price and liquidity. This concentration also implies a low level of decentralization, which may conflict with the principles of many blockchain projects. Furthermore, any large-scale movement from the top addresses could trigger significant price volatility.

From a market structure perspective, this distribution suggests a relatively immature ecosystem for ICE, with limited widespread adoption. The high concentration in few addresses may indicate early-stage distribution or strategic holdings by project insiders or large investors. Potential investors should be aware of these on-chain dynamics when considering ICE's market behavior and long-term prospects.

Click to view the current ICE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xeaed...6a6b8d | 12381169.51K | 58.53% |

| 2 | 0x611f...dfb09d | 1946179.34K | 9.20% |

| 3 | 0x2e8f...725e64 | 568621.51K | 2.68% |

| 4 | 0xd621...d19a2c | 457513.47K | 2.16% |

| 5 | 0xffa8...44cd54 | 402001.33K | 1.90% |

| - | Others | 5395052.28K | 25.53% |

II. Key Factors Affecting ICE's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are increasingly showing interest in ICE, with companies like MicroStrategy making significant purchases of over 51,780 bitcoins worth approximately $4.6 billion.

- Corporate Adoption: Notable companies are exploring ICE adoption, with Trump Media & Technology Group in talks to acquire Bakkt, a cryptocurrency trading platform owned by ICE.

- Government Policies: The potential Trump administration is expected to implement favorable policies for the cryptocurrency industry, including possibly incorporating ICE into government reserves and establishing a presidential advisory committee.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate decisions, such as the recent 25 basis point rate cut, are influencing market liquidity and ICE demand.

- Inflation Hedging Properties: ICE is increasingly viewed as a potential hedge against inflation, especially with concerns about rising US inflation due to proposed Trump policies.

- Geopolitical Factors: The global economic and political landscape, including the US election results and potential regulatory changes, are significantly impacting ICE's market sentiment.

Technological Developments and Ecosystem Building

- Regulatory Framework: The cryptocurrency industry is moving towards increased regulation, which could lead to a more structured and potentially safer market for ICE investors.

- ETF Developments: The introduction of ICE spot ETFs has lowered entry barriers for investors, potentially increasing market participation and capital inflow.

- Ecosystem Applications: The focus on Real World Assets (RWA) and Payment Finance (PayFi) is expected to be key areas of innovation in the current market cycle, potentially affecting ICE's utility and adoption.

III. ICE Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00445 - $0.00556

- Neutral forecast: $0.00556 - $0.00620

- Optimistic forecast: $0.00620 - $0.00684 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.00627 - $0.01026

- 2028: $0.00723 - $0.01014

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00759 - $0.01133 (assuming steady market growth)

- Optimistic scenario: $0.01133 - $0.01269 (assuming strong market performance)

- Transformative scenario: $0.01269+ (under extremely favorable conditions)

- 2030-12-31: ICE $0.01133 (potential market stabilization)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00684 | 0.00556 | 0.00445 | 0 |

| 2026 | 0.00856 | 0.0062 | 0.0044 | 11 |

| 2027 | 0.01026 | 0.00738 | 0.00627 | 32 |

| 2028 | 0.01014 | 0.00882 | 0.00723 | 58 |

| 2029 | 0.01318 | 0.00948 | 0.00531 | 70 |

| 2030 | 0.01269 | 0.01133 | 0.00759 | 103 |

IV. Professional ICE Investment Strategies and Risk Management

ICE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate ICE tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure wallets with regular security audits

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification and support/resistance levels

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor ICE's correlation with broader crypto market trends

- Set strict stop-loss and take-profit levels

ICE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ICE

ICE Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity: Potential issues with trading volume and market depth

- Competition: Emerging Layer 1 blockchains may impact ICE's market position

ICE Regulatory Risks

- Global regulatory uncertainty: Changing policies may affect ICE's operations

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Potential limitations on ICE's global accessibility

ICE Technical Risks

- Network security: Vulnerability to potential hacks or exploits

- Scalability issues: Challenges in handling increased network traffic

- Smart contract risks: Potential bugs or vulnerabilities in dApp ecosystem

VI. Conclusion and Action Recommendations

ICE Investment Value Assessment

ICE offers innovative blockchain solutions with potential long-term value, but faces significant short-term risks due to market volatility and regulatory uncertainties.

ICE Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider ICE as part of a diversified crypto portfolio

ICE Trading Participation Methods

- Spot trading: Direct purchase and sale of ICE tokens on Gate.com

- Staking: Participate in ICE network validation for potential rewards

- DeFi integration: Explore ICE-based decentralized finance applications

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will be the price of ice in 2025?

Based on current market analysis, the price of ICE is predicted to reach around $0.028 by 2025. This represents a potential gain of about 88% compared to today's average price.

Is ice a buy or sell?

Based on current market analysis, ICE is considered a buy. Analysts are optimistic about its potential for growth and value appreciation in the near future.

Will ice coin value increase?

Yes, ICE coin value is likely to increase. With its unique 'tap to mine' technology, multi-chain integration, and deflationary tokenomics, ICE is positioned for growth. Projections suggest potential price increases in the coming years.

Is ice a good investment?

Yes, ICE shows strong potential as a long-term investment. It ranks 7th among top stocks to buy and hold for 10 years, indicating solid growth prospects and market stability.

Share

Content