2025 OAS Price Prediction: Analyzing Market Trends and Growth Potential for OpenSea's Native Token

Introduction: OAS Market Position and Investment Value

Oasys (OAS), as a public blockchain specialized in gaming, has made significant strides since its launch. As of 2025, Oasys has achieved a market capitalization of $44,384,332, with a circulating supply of approximately 4,947,534,564 tokens and a price hovering around $0.008971. This asset, known as the "blockchain of games," is playing an increasingly crucial role in the gaming industry.

This article will provide a comprehensive analysis of Oasys' price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. OAS Price History Review and Current Market Status

OAS Historical Price Evolution Trajectory

- 2024: All-time high reached on February 13, price peaked at $0.141992

- 2025: Significant market downturn, price dropped to all-time low of $0.00860625 on September 30

OAS Current Market Situation

As of October 1, 2025, OAS is trading at $0.008971, with a 24-hour trading volume of $17,714.028. The token has experienced a slight decrease of 0.51% in the last 24 hours. OAS currently ranks 738th in the cryptocurrency market with a market capitalization of $44,384,332.58.

The token's price is showing mixed short-term performance, with a 0.45% increase in the last hour but a 11.79% decrease over the past week. The long-term trend appears bearish, as evidenced by the 21.99% decline over the last 30 days and a substantial 76.62% drop in the past year.

OAS has a circulating supply of 4,947,534,564.82 tokens, which represents 49.48% of its total supply of 10,000,000,000 tokens. The fully diluted market cap stands at $89,710,000.

Click to view the current OAS market price

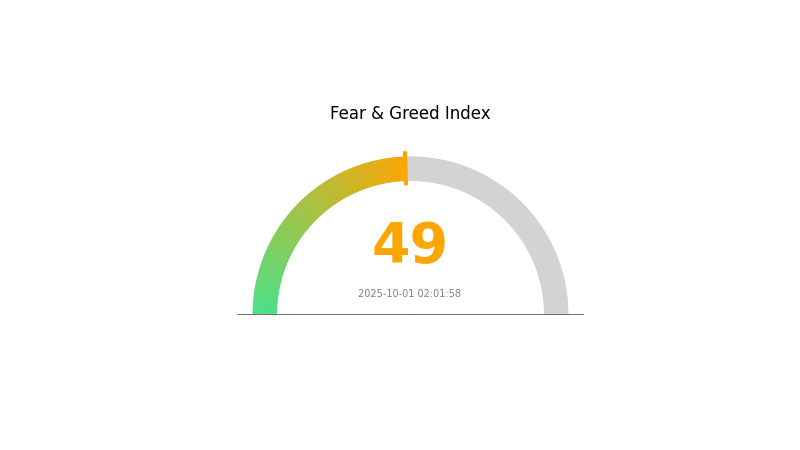

OAS Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 49, indicating a neutral stance. This equilibrium suggests that investors are neither overly pessimistic nor excessively optimistic about the market's short-term prospects. Traders should remain vigilant and consider diversifying their portfolios to mitigate potential risks while being prepared for potential opportunities. As always, it's crucial to conduct thorough research and exercise caution when making investment decisions in the volatile crypto market.

OAS Holdings Distribution

The address holdings distribution data for OAS reveals an interesting pattern in token concentration. While the provided table is empty, this absence of data could indicate either a highly decentralized distribution or a lack of available information.

In the absence of specific concentration data, we can infer that OAS may have a relatively dispersed ownership structure. This potential decentralization could contribute to a more stable market, as it reduces the risk of large holders significantly influencing price movements through substantial sell-offs or accumulations.

However, without concrete data, it's crucial to approach this analysis with caution. The market structure and potential for price volatility remain uncertain, highlighting the need for further investigation into OAS's on-chain metrics to gain a comprehensive understanding of its market characteristics and overall stability.

Click to view the current OAS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting Future OAS Prices

Macroeconomic Environment

-

Impact of Monetary Policy: The Federal Reserve is expected to start cutting interest rates in Q4 2025. The market currently anticipates the federal funds rate to drop below 3% once the easing cycle begins.

-

Inflation Hedging Properties: There are expectations of inflation declining and economic growth slowing down by 2026, which could impact OAS prices.

-

Geopolitical Factors: The ongoing US-China trade tensions and potential tariff changes continue to influence market sentiment. Any resumption of "reciprocal" tariff mechanisms could reverse optimistic market expectations.

Technical Development and Ecosystem Building

- Yield Curve Trends: The yield curve is potentially at a critical point, transitioning from a "bear steepener" to a "bull steepener". This shift is driven by market expectations of inflation decline and economic slowdown in 2026.

Institutional and Whale Dynamics

-

Institutional Holdings: Major US banks have shown a cautious approach towards agency MBS holdings in Q1 2025, with some reducing their available-for-sale (AFS) positions.

-

Corporate Adoption: Banks are increasingly favoring floating-rate and short-duration Collateralized Mortgage Obligation (CMO) tranches to manage duration risk while capturing yield spreads.

-

National Policies: China's central economic work conference in 2024 called for a "more proactive" fiscal policy and a "moderately loose" monetary policy. The April 2025 Politburo meeting emphasized stabilizing the real estate market and promoting consumption.

III. OAS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00738 - $0.00911

- Neutral prediction: $0.00911 - $0.00975

- Optimistic prediction: $0.00975 - $0.01 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00631 - $0.01678

- 2028: $0.00743 - $0.01669

- Key catalysts: Technological advancements, wider ecosystem integration, and market cycle trends

2029-2030 Long-term Outlook

- Base scenario: $0.01536 - $0.01674 (assuming steady market growth and adoption)

- Optimistic scenario: $0.01812 - $0.02009 (assuming strong market performance and increased utility)

- Transformative scenario: $0.02009 - $0.025 (assuming breakthrough innovations and mainstream acceptance)

- 2030-12-31: OAS $0.02009 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00975 | 0.00911 | 0.00738 | 1 |

| 2026 | 0.0131 | 0.00943 | 0.00839 | 5 |

| 2027 | 0.01678 | 0.01127 | 0.00631 | 25 |

| 2028 | 0.01669 | 0.01402 | 0.00743 | 56 |

| 2029 | 0.01812 | 0.01536 | 0.01459 | 71 |

| 2030 | 0.02009 | 0.01674 | 0.01055 | 86 |

IV. Professional Investment Strategies and Risk Management for OAS

OAS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate OAS during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Watch for support and resistance levels

- Use stop-loss orders to manage risk

OAS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for OAS

OAS Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid shifts based on news and trends

OAS Regulatory Risks

- Uncertain regulations: Potential for new laws affecting OAS and gaming tokens

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

OAS Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Possible network congestion during high usage periods

- Interoperability issues: Compatibility problems with other blockchain networks

VI. Conclusion and Action Recommendations

OAS Investment Value Assessment

OAS presents a unique opportunity in the blockchain gaming sector, with potential for long-term growth. However, investors should be aware of short-term volatility and regulatory uncertainties.

OAS Investment Recommendations

✅ Beginners: Start with small positions and focus on learning the technology ✅ Experienced investors: Consider a balanced approach with regular rebalancing ✅ Institutional investors: Conduct thorough due diligence and implement robust risk management

OAS Trading Participation Methods

- Spot trading: Buy and sell OAS on Gate.com

- Staking: Participate in OAS staking programs for potential rewards

- DeFi integration: Explore decentralized finance opportunities using OAS

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

As of 2025, Bitcoin is predicted to have the highest price, followed by Ethereum. These two cryptocurrencies are expected to maintain their leading positions in terms of value and market dominance.

What is the XRP price prediction in 2025?

Based on current trends, XRP is predicted to reach around $3.50 to $4.00 by the end of 2025, driven by increased adoption and regulatory clarity.

What is the prediction for Oasis Network 2025?

Oasis Network's price is predicted to reach $0.035242 in 2025, based on neutral sentiment and mixed technical signals.

Will Shiba Inu price prediction 2030?

Shiba Inu price may reach $0.00001 by 2030, based on current trends and market analysis. However, crypto markets are highly volatile and unpredictable.

Share

Content