2025 PUFFER Price Prediction: Analyzing Future Growth Potential and Market Factors for This Emerging Cryptocurrency

Introduction: PUFFER's Market Position and Investment Value

Puffer (PUFFER), as a leading innovator in Ethereum infrastructure, has been enhancing Ethereum's scalability and security since its inception. As of 2025, PUFFER's market capitalization has reached $36,475,493, with a circulating supply of approximately 203,887,613 tokens, and a price hovering around $0.1789. This asset, known as the "Ethereum Enhancer," is playing an increasingly crucial role in improving blockchain scalability and security.

This article will provide a comprehensive analysis of PUFFER's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PUFFER Price History Review and Current Market Status

PUFFER Historical Price Evolution

- 2024: PUFFER launched, price reached all-time high of $1.0094 on December 7

- 2025: Market correction, price dropped to all-time low of $0.1379 on April 7

- 2025: Gradual recovery, current price stabilized around $0.1789

PUFFER Current Market Situation

As of October 2, 2025, PUFFER is trading at $0.1789, with a 24-hour trading volume of $271,160. The token has shown positive momentum in the short term, with a 7.25% increase in the last 24 hours and a 1.59% gain in the past hour. However, looking at longer timeframes, PUFFER has experienced declines of 4.27% over the past week, 11.70% over the last month, and a significant 39.32% drop over the past year.

PUFFER's market capitalization currently stands at $36,475,493, ranking it 829th among all cryptocurrencies. The circulating supply is 203,887,613 PUFFER tokens, which represents 20.39% of the total supply of 1 billion tokens. The fully diluted market cap is $178,900,000.

Click to view the current PUFFER market price

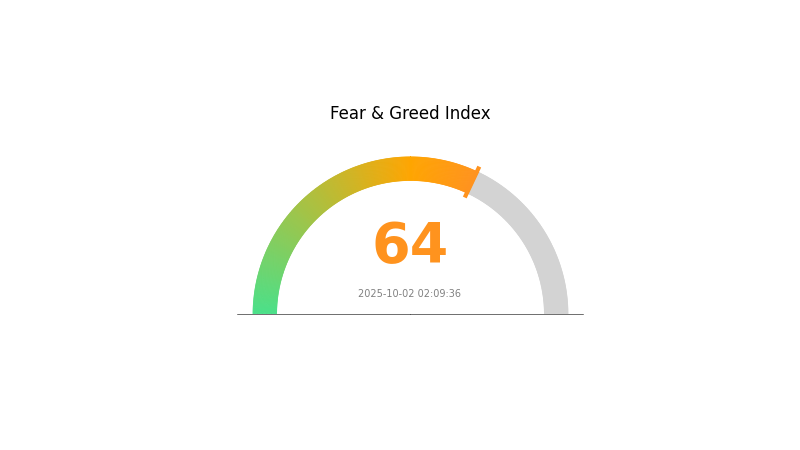

PUFFER Market Sentiment Indicator

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 64. This suggests that investors are becoming increasingly optimistic about the market's potential. However, it's crucial to remain cautious and avoid making impulsive decisions based solely on market sentiment. Remember to conduct thorough research and consider your risk tolerance before making any investment choices. Gate.com offers a range of tools and resources to help you navigate the market effectively.

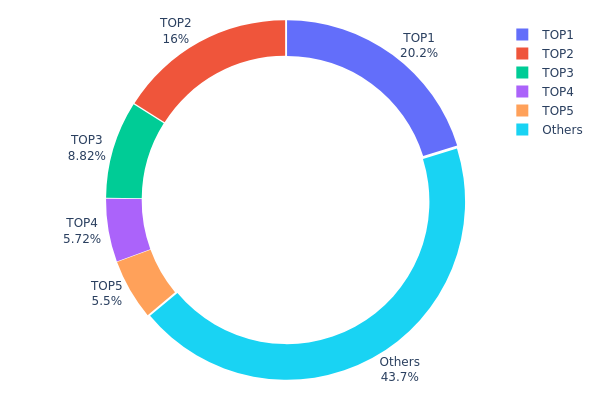

PUFFER Holdings Distribution

The address holdings distribution data for PUFFER reveals a significant concentration of tokens among a few top addresses. The top 5 addresses collectively hold 56.24% of the total supply, with the largest single address controlling 20.18% of PUFFER tokens. This level of concentration indicates a relatively centralized ownership structure, which could potentially impact market dynamics.

Such a concentrated distribution raises concerns about market manipulation and price volatility. With over half of the supply controlled by just five addresses, there's an increased risk of large-scale sell-offs or coordinated actions that could significantly influence PUFFER's price. Additionally, this concentration may affect the token's liquidity and overall market stability.

While 43.76% of tokens are distributed among other addresses, suggesting some level of wider adoption, the current distribution pattern reflects a relatively low degree of decentralization. This structure may pose challenges for PUFFER's long-term sustainability and could be a point of consideration for potential investors assessing the token's risk profile and governance implications.

Click to view the current PUFFER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa600...b7a7c0 | 201890.67K | 20.18% |

| 2 | 0xcc7b...d572b3 | 160336.58K | 16.03% |

| 3 | 0x2cde...48f00c | 88193.82K | 8.81% |

| 4 | 0x5fee...c134a7 | 57210.23K | 5.72% |

| 5 | 0xff00...cbc82b | 55000.00K | 5.50% |

| - | Others | 437368.71K | 43.76% |

II. Key Factors Influencing PUFFER's Future Price

Supply Mechanism

- Staking and Restaking: These mechanisms enhance Ethereum's security and stability while promoting ecosystem development, potentially supporting PUFFER's price.

- Current Impact: The implementation of staking and restaking is expected to have a positive influence on PUFFER's price by increasing user trust and network stability.

Institutional and Whale Dynamics

- Enterprise Adoption: As PUFFER is closely tied to Ethereum's ecosystem, increased adoption of Ethereum by major enterprises could indirectly benefit PUFFER.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's interest rate decisions, including the transition from rate hikes to cuts, may cause market sentiment fluctuations affecting PUFFER's price.

- Geopolitical Factors: Geopolitical tensions have been noted as a source of volatility in the cryptocurrency market, potentially impacting PUFFER's price movements.

Technical Development and Ecosystem Building

- Node Infrastructure: The number of nodes, node security, and protocol fee revenues are crucial variables affecting PUFFER's operations and development.

- Ecosystem Applications: As a part of the Ethereum ecosystem, PUFFER's value may be influenced by the growth and success of DApps and other ecosystem projects built on Ethereum.

III. PUFFER Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.16958 - $0.1785

- Neutral prediction: $0.1785 - $0.21777

- Optimistic prediction: $0.21777 - $0.25704 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.1353 - $0.28959

- 2028: $0.21869 - $0.37414

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.31881 - $0.37141 (assuming steady market growth)

- Optimistic scenario: $0.37141 - $0.42402 (assuming strong market performance)

- Transformative scenario: Up to $0.42402 (with exceptional market conditions)

- 2030-12-31: PUFFER $0.38256 (potential peak within the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.25704 | 0.1785 | 0.16958 | 0 |

| 2026 | 0.25697 | 0.21777 | 0.15244 | 21 |

| 2027 | 0.28959 | 0.23737 | 0.1353 | 32 |

| 2028 | 0.37414 | 0.26348 | 0.21869 | 47 |

| 2029 | 0.42402 | 0.31881 | 0.22317 | 78 |

| 2030 | 0.38256 | 0.37141 | 0.31199 | 107 |

IV. PUFFER Professional Investment Strategies and Risk Management

PUFFER Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in Ethereum's long-term growth

- Operation suggestions:

- Accumulate PUFFER tokens during market dips

- Hold for at least 1-2 years to potentially benefit from Ethereum ecosystem growth

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor Ethereum network upgrades and their impact on PUFFER

- Pay attention to overall crypto market sentiment and its influence on PUFFER price

PUFFER Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk appetite

(2) Risk Hedging Solutions

- Diversification: Spread investments across various Ethereum ecosystem projects

- Stop-loss orders: Implement to limit potential losses in volatile market conditions

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Use reputable Ethereum-compatible wallets

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. PUFFER Potential Risks and Challenges

PUFFER Market Risks

- High volatility: PUFFER price may experience significant fluctuations

- Competition: Other Ethereum scaling solutions may impact PUFFER's market share

- Market sentiment: Overall crypto market trends can heavily influence PUFFER's performance

PUFFER Regulatory Risks

- Uncertain regulatory landscape: Changes in crypto regulations may affect PUFFER's operations

- Compliance challenges: Evolving legal requirements could impact PUFFER's adoption

- Cross-border restrictions: International regulatory differences may limit global expansion

PUFFER Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in PUFFER's protocols

- Scalability challenges: Unforeseen issues in scaling Ethereum infrastructure

- Interoperability concerns: Compatibility issues with other blockchain networks or protocols

VI. Conclusion and Action Recommendations

PUFFER Investment Value Assessment

PUFFER presents a high-risk, high-potential opportunity within the Ethereum ecosystem. Its focus on improving Ethereum's scalability and security could drive long-term value, but short-term volatility and technical risks must be carefully considered.

PUFFER Investment Recommendations

✅ Beginners: Start with small positions and focus on understanding Ethereum infrastructure ✅ Experienced investors: Consider allocating a portion of their Ethereum-focused portfolio to PUFFER ✅ Institutional investors: Evaluate PUFFER as part of a broader Ethereum ecosystem investment strategy

PUFFER Trading Participation Methods

- Spot trading: Buy and sell PUFFER tokens on Gate.com

- Staking: Participate in PUFFER's liquid restaking protocol if available

- DeFi integration: Explore PUFFER-related DeFi opportunities as they develop

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the all time high of puffer coin?

The all-time high of Puffer coin was $0.9908, reached in the past. This represents the highest price point in the coin's history since its launch.

What meme coin will explode in 2025 price prediction?

PEPE coin is predicted to explode in 2025, potentially reaching $0.0001 due to its strong community and viral marketing potential.

What is puffer crypto?

Puffer is a DeFi platform focused on providing liquidity and yield generation. It aims to optimize returns for users in the decentralized finance ecosystem.

Which AI is best for stock price prediction?

LSTM, SVM, and ANN are top AI methods for stock price prediction, with LSTM often excelling due to its ability to capture long-term dependencies in time series data.

Share

Content