2025 SHELL Price Prediction: Analyzing Market Trends and Environmental Factors Shaping Royal Dutch Shell's Financial Outlook

Introduction: SHELL's Market Position and Investment Value

MyShell (SHELL), as an AI consumer layer platform, has been enabling users to create, share, and own AI agents since its inception in 2023. As of 2025, MyShell's market capitalization has reached $32,192,100, with a circulating supply of approximately 270,000,000 tokens, and a price hovering around $0.11923. This asset, often referred to as the "AI-Blockchain Bridge," is playing an increasingly crucial role in the fields of AI technology and blockchain integration.

This article will provide a comprehensive analysis of MyShell's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SHELL Price History Review and Current Market Status

SHELL Historical Price Evolution

- 2025 (February): SHELL reached its all-time high of $0.7023

- 2025 (September): SHELL hit its all-time low of $0.10584

- 2025 (October): SHELL price recovered slightly to $0.11923

SHELL Current Market Situation

As of October 2, 2025, SHELL is trading at $0.11923, with a market cap of $32,192,100. The token has seen a 4.68% increase in the last 24 hours, with a trading volume of $348,675.83. SHELL's current price is 83.01% below its all-time high and 12.65% above its all-time low. The token's circulating supply is 270,000,000 SHELL, which represents 27% of its total supply of 1,000,000,000 SHELL. SHELL's market dominance stands at 0.0027%, indicating its relatively small position in the overall cryptocurrency market.

Click to view the current SHELL market price

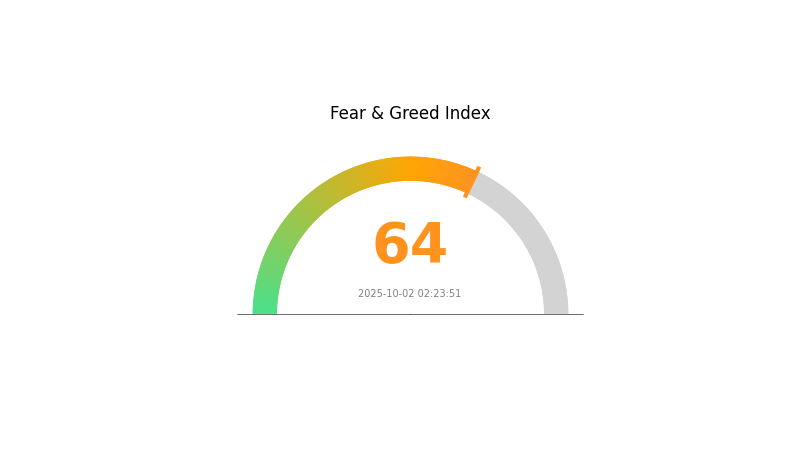

SHELL Market Sentiment Indicator

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a wave of optimism, with the Fear and Greed Index standing at 64, indicating a state of greed. This suggests that investors are feeling confident and bullish about the market's prospects. However, it's important to remember that excessive greed can lead to overvaluation and potential market corrections. Traders should exercise caution and maintain a balanced approach to their investment strategies. As always, thorough research and risk management are crucial in navigating the volatile crypto landscape.

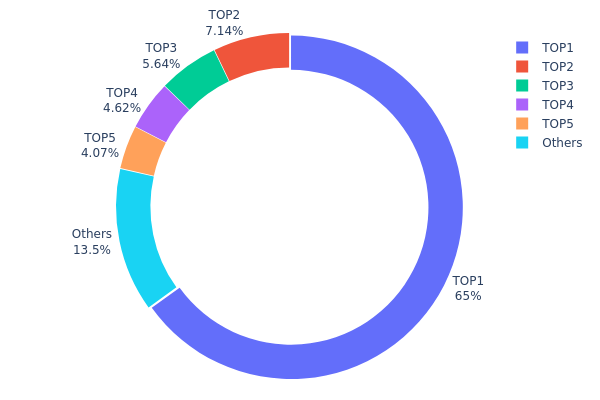

SHELL Holdings Distribution

The address holdings distribution data for SHELL reveals a highly concentrated ownership structure. The top address holds a staggering 65.04% of the total supply, amounting to 320,000.00K SHELL tokens. This level of concentration is significant and potentially concerning for market dynamics.

Following the top holder, the next four largest addresses collectively account for an additional 21.45% of the supply. This means that the top five addresses control 86.49% of all SHELL tokens, leaving only 13.51% distributed among other holders. Such a concentrated distribution raises questions about the token's decentralization and market manipulation risks.

This high concentration of SHELL holdings in a few addresses could lead to increased price volatility and susceptibility to large market movements initiated by these major holders. It may also impact liquidity and potentially deter smaller investors due to perceived centralization risks. Monitoring these top addresses for any significant changes in holdings will be crucial for understanding future market dynamics and potential price actions in the SHELL ecosystem.

Click to view the current SHELL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb760...f96b0c | 320000.00K | 65.04% |

| 2 | 0xc336...e6cf58 | 35146.10K | 7.14% |

| 3 | 0xf977...41acec | 27755.37K | 5.64% |

| 4 | 0xc3b9...c7da6f | 22712.75K | 4.61% |

| 5 | 0x5a52...70efcb | 20000.00K | 4.06% |

| - | Others | 66354.43K | 13.51% |

II. Key Factors Affecting SHELL's Future Price

Supply Mechanism

- Oil and Gas Price Fluctuations: SHELL's future operations are significantly influenced by the volatility in oil and natural gas prices.

- Current Impact: In the first half of 2025, continuous decline in oil prices has affected SHELL's profitability.

Institutional and Major Player Dynamics

- Corporate Adoption: SHELL's refining business is impacted by intensified global market competition. New refineries in Asia and Africa have increased supply, while economic slowdown in Europe has reduced demand, leading to a decline in refined product prices and profits.

Macroeconomic Environment

- Geopolitical Factors: Global market competition and regional economic conditions significantly affect SHELL's performance.

Technological Development and Ecosystem Building

- Energy Transition: The world's shift towards cleaner and more sustainable energy sources is increasing demand for Shell core transformers, which facilitate the integration of renewable energy into the grid.

- Ecosystem Applications: SHELL is adapting to the global energy transition, with potential impacts on its long-term business model and profitability.

III. SHELL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.09618 - $0.11000

- Neutral prediction: $0.11000 - $0.12000

- Optimistic prediction: $0.12000 - $0.12349 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.08127 - $0.19061

- 2028: $0.11843 - $0.24532

- Key catalysts: Increased adoption, technological improvements

2029-2030 Long-term Outlook

- Base scenario: $0.20725 - $0.24145 (assuming steady market growth)

- Optimistic scenario: $0.24145 - $0.2994 (assuming strong market performance)

- Transformative scenario: Above $0.2994 (extreme favorable conditions)

- 2030-12-31: SHELL $0.2994 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.12349 | 0.11874 | 0.09618 | 0 |

| 2026 | 0.17441 | 0.12111 | 0.11264 | 1 |

| 2027 | 0.19061 | 0.14776 | 0.08127 | 23 |

| 2028 | 0.24532 | 0.16919 | 0.11843 | 41 |

| 2029 | 0.27565 | 0.20725 | 0.12642 | 73 |

| 2030 | 0.2994 | 0.24145 | 0.15211 | 102 |

IV. SHELL Professional Investment Strategies and Risk Management

SHELL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and AI technology enthusiasts

- Operation suggestions:

- Accumulate SHELL tokens during market dips

- Stay updated with MyShell's AI technology advancements

- Store tokens securely in a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to manage downside risk

- Take profits at predetermined resistance levels

SHELL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate investments across multiple AI-related projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Software wallet option: Official MyShell wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. SHELL Potential Risks and Challenges

SHELL Market Risks

- High volatility: Cryptocurrency markets are known for rapid price fluctuations

- Competition: Other AI-focused blockchain projects may emerge as strong competitors

- Market sentiment: General crypto market trends can significantly impact SHELL's price

SHELL Regulatory Risks

- Uncertain regulations: Evolving cryptocurrency regulations may affect SHELL's adoption

- Cross-border restrictions: International regulatory differences could limit global usage

- AI governance: Potential regulations on AI technologies may impact MyShell's operations

SHELL Technical Risks

- Smart contract vulnerabilities: Potential security issues in the token's underlying code

- Scalability challenges: MyShell's AI platform may face performance issues as it grows

- Technological obsolescence: Rapid advancements in AI could outpace MyShell's development

VI. Conclusion and Action Recommendations

SHELL Investment Value Assessment

SHELL presents a unique opportunity in the intersection of AI and blockchain technologies. While it offers long-term potential in the growing AI market, short-term volatility and regulatory uncertainties pose significant risks.

SHELL Investment Recommendations

✅ Beginners: Consider small, long-term investments after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct comprehensive due diligence and consider SHELL as part of a diversified AI-blockchain portfolio

SHELL Trading Participation Methods

- Spot trading: Purchase SHELL tokens on Gate.com

- Staking: Participate in staking programs if offered by MyShell

- AI agent creation: Engage with the MyShell platform to understand the ecosystem better

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Shell stock expected to rise?

Yes, Shell stock is expected to rise. Analysts predict a 5.87% increase over the next 12 months, based on current market trends and positive outlook.

Is it smart to invest in Shell?

Yes, investing in Shell can be smart. It has a strong market position, consistent dividends, and potential for growth in the energy sector.

Why is Shell's price dropping?

Shell's price is dropping due to lower oil prices, reduced gas trading profits, and losses in chemical operations. However, earnings still exceeded analyst forecasts.

Is Shell stock overvalued?

As of 2025-10-02, Shell stock is undervalued by 59% compared to its market price, suggesting it may be a good investment opportunity.

Share

Content