2025 TOKEN Price Prediction: Analyzing Market Trends and Growth Potential for the Coming Bull Run

Introduction: TOKEN's Market Position and Investment Value

TokenFi (TOKEN) has established itself as a pioneering all-in-one tokenization platform since its inception. As of 2025, TokenFi's market capitalization has reached $36,773,941, with a circulating supply of approximately 2,881,970,373 tokens, and a price hovering around $0.01276. This asset, dubbed the "tokenization enabler," is playing an increasingly crucial role in the rapidly growing tokenization industry.

This article will provide a comprehensive analysis of TokenFi's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer investors professional price predictions and practical investment strategies.

I. TOKEN Price History Review and Current Market Status

TOKEN Historical Price Evolution

- 2024: Launch on March 26, price reached all-time high of $0.24646

- 2025: Market correction, price dropped to all-time low of $0.01112 on April 7

- 2025: Gradual recovery, current price at $0.01276 as of October 2

TOKEN Current Market Situation

TOKEN is currently trading at $0.01276, showing a 7.22% increase in the last 24 hours. The token has a market cap of $36,773,941 and a fully diluted valuation of $127,600,000. With a circulating supply of 2,881,970,373 TOKEN, representing 28.82% of the total supply, the token has seen positive short-term price movements. Over the past week, TOKEN has gained 4.42%, and in the last 30 days, it has increased by 6.16%. However, the token is down 73.69% compared to its price one year ago, indicating significant volatility over the long term.

Click to view the current TOKEN market price

TOKEN Market Sentiment Indicator

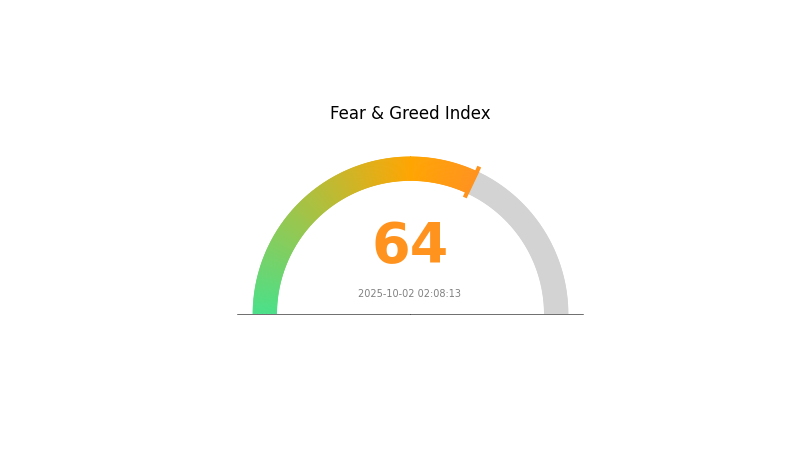

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance as the Fear and Greed Index reaches 64, indicating a state of greed. This suggests investors are becoming increasingly optimistic, potentially driving up prices. However, caution is advised as high greed levels often precede market corrections. Traders should consider taking profits or hedging positions. Remember, successful investing often involves going against the crowd. Stay informed and manage your risk wisely on Gate.com, your trusted crypto trading platform.

TOKEN Holdings Distribution

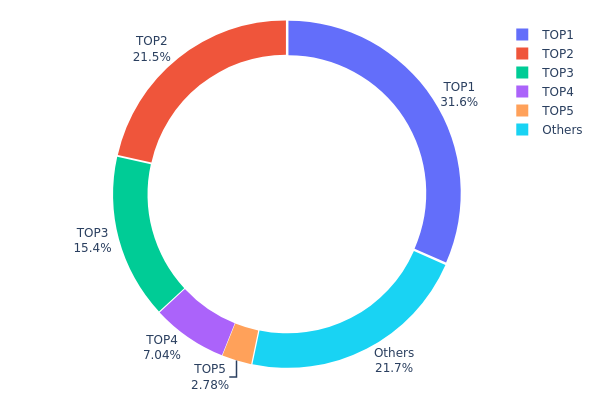

The address holdings distribution chart provides insights into the concentration of TOKEN ownership. Analysis of the data reveals a significant level of centralization, with the top 5 addresses controlling 78.3% of the total supply. The largest holder possesses 31.60% of tokens, followed by the second and third largest holders with 21.49% and 15.40% respectively.

This high concentration of tokens in a few addresses raises concerns about potential market manipulation and price volatility. With such a large portion of the supply controlled by a small number of entities, there is an increased risk of sudden large-scale sell-offs or accumulations that could dramatically impact TOKEN's market price. Additionally, this centralization may undermine the project's claims of decentralization and could potentially affect governance decisions if the TOKEN is used for voting rights.

The current distribution pattern suggests a relatively immature market structure with limited widespread adoption. While the presence of 21.7% of tokens held by "Others" indicates some level of distribution, the overall picture points to a need for greater token dispersal to enhance market stability and reduce manipulation risks.

Click to view the current TOKEN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb8d2...f4ee43 | 1580272.40K | 31.60% |

| 2 | 0x2b9d...d60ab0 | 1074642.31K | 21.49% |

| 3 | 0x1e78...2f7ecd | 770090.96K | 15.40% |

| 4 | 0x6522...837e90 | 352048.20K | 7.04% |

| 5 | 0xc882...84f071 | 138792.59K | 2.77% |

| - | Others | 1084153.53K | 21.7% |

II. Key Factors Affecting TOKEN's Future Price

Supply Mechanism

- Token Distribution: The total supply of tokens is often limited, with a portion released initially and the rest distributed over time.

- Historical Pattern: Changes in token supply have historically impacted price, with scarcity often driving up value.

- Current Impact: Expected supply changes may influence investor sentiment and token valuation.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are increasingly showing interest in cryptocurrency investments, potentially including this token.

- Corporate Adoption: Some forward-thinking companies may be exploring the use of blockchain technology and associated tokens.

- Government Policies: Various countries are developing regulations around cryptocurrencies, which could affect token adoption and value.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially regarding interest rates and inflation, can influence cryptocurrency markets.

- Inflation Hedging Properties: Some investors view certain cryptocurrencies as potential hedges against inflation.

- Geopolitical Factors: Global political and economic events can impact the perceived value and adoption of cryptocurrencies.

Technical Development and Ecosystem Building

- Blockchain Upgrades: Ongoing improvements to the underlying blockchain technology can enhance performance and attract more users.

- Scalability Solutions: Implementation of layer-2 solutions or other scaling technologies may increase the token's utility and value.

- Ecosystem Applications: The development of DApps and other ecosystem projects can drive demand for the token and increase its overall value proposition.

III. TOKEN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01133 - $0.01273

- Neutral prediction: $0.01273 - $0.01368

- Optimistic prediction: $0.01368 - $0.01464 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01503 - $0.0172

- 2028: $0.00949 - $0.02

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.02048 - $0.02133 (assuming steady market growth)

- Optimistic scenario: $0.02133 - $0.03115 (assuming favorable market conditions)

- Transformative scenario: $0.03115+ (assuming extremely favorable market conditions and widespread adoption)

- 2030-12-31: TOKEN $0.03115 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01464 | 0.01273 | 0.01133 | 0 |

| 2026 | 0.01971 | 0.01368 | 0.01327 | 7 |

| 2027 | 0.0172 | 0.0167 | 0.01503 | 30 |

| 2028 | 0.02 | 0.01695 | 0.00949 | 32 |

| 2029 | 0.0242 | 0.01847 | 0.01367 | 44 |

| 2030 | 0.03115 | 0.02133 | 0.02048 | 67 |

IV. Professional Investment Strategies and Risk Management for TOKEN

TOKEN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operation suggestions:

- Accumulate TOKEN during market dips

- Set price targets and stick to them

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined levels

TOKEN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options trading: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official TokenFi wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TOKEN

TOKEN Market Risks

- High volatility: TOKEN price may experience significant fluctuations

- Liquidity risk: Limited trading volume may affect ability to buy or sell

- Market sentiment: Influenced by overall cryptocurrency market trends

TOKEN Regulatory Risks

- Uncertain regulations: Potential for new laws affecting TOKEN's status

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrency transactions

TOKEN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: High transaction fees during peak usage

- Technological obsolescence: Risk of being overtaken by newer projects

VI. Conclusion and Action Recommendations

TOKEN Investment Value Assessment

TOKEN presents a high-risk, high-reward opportunity in the growing tokenization industry. While it offers potential for significant gains, investors should be prepared for extreme volatility and potential losses.

TOKEN Investment Recommendations

✅ Beginners: Start with small investments and focus on education ✅ Experienced investors: Consider allocating a portion of crypto portfolio to TOKEN ✅ Institutional investors: Conduct thorough due diligence and consider OTC options

TOKEN Trading Participation Methods

- Spot trading: Buy and sell TOKEN on Gate.com

- Staking: Participate in staking programs if offered by TokenFi

- DeFi integration: Explore decentralized finance options using TOKEN

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Which token will explode in 2025?

Bitcoin Hyper (BTC fork) and Maxi Doge are predicted to explode in 2025, offering optimized speed, staking, and high leverage potential.

What is the price prediction for token coin?

TOKEN is expected to reach a high of $0.021913 in March and a low of $0.011267 in December 2025. The overall trend suggests moderate price fluctuations throughout the year.

What crypto will 1000x prediction?

Emerging AI and metaverse tokens show potential for 1000x growth by 2026. Look for projects with strong tech and partnerships in these sectors.

Which coin will boom in 2030?

Bitcoin is likely to boom in 2030, potentially reaching $500,000 per coin due to increased adoption and limited supply.

Share

Content