2025 VELVET Price Prediction: Analyzing Growth Potential and Market Factors for the Digital Asset

Introduction: VELVET's Market Position and Investment Value

Velvet (VELVET), as a DeFAI Operating System for streamlining onchain research, trading, and portfolio management, has achieved significant milestones since its inception. As of 2025, VELVET's market capitalization has reached $41,904,930, with a circulating supply of approximately 248,266,667 tokens, and a price hovering around $0.16879. This asset, often referred to as a "DeFi innovation enabler," is playing an increasingly crucial role in decentralized finance and AI-driven investment strategies.

This article will provide a comprehensive analysis of VELVET's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. VELVET Price History Review and Current Market Status

VELVET Historical Price Evolution

- 2025 July: VELVET reached its all-time low of $0.037, marking the beginning of its market presence

- 2025 September: VELVET hit its all-time high of $0.32332, showing significant growth in a short period

- 2025 October: The price has experienced a correction, currently trading at $0.16879

VELVET Current Market Situation

As of October 1, 2025, VELVET is trading at $0.16879. The token has seen a 6.65% decrease in the last 24 hours, with a trading volume of $210,986.51. VELVET's market capitalization stands at $41,904,930.72, ranking it 763rd in the overall cryptocurrency market. The token has a circulating supply of 248,266,667 VELVET out of a total supply of 1,000,000,000. Despite the recent 24-hour decline, VELVET has shown impressive growth over longer periods, with a 165.11% increase over the past 30 days and a staggering 423.24% gain over the last year. The current price represents a 356% increase from its all-time low but is still 47.8% below its all-time high, indicating potential for further growth.

Click to view the current VELVET market price

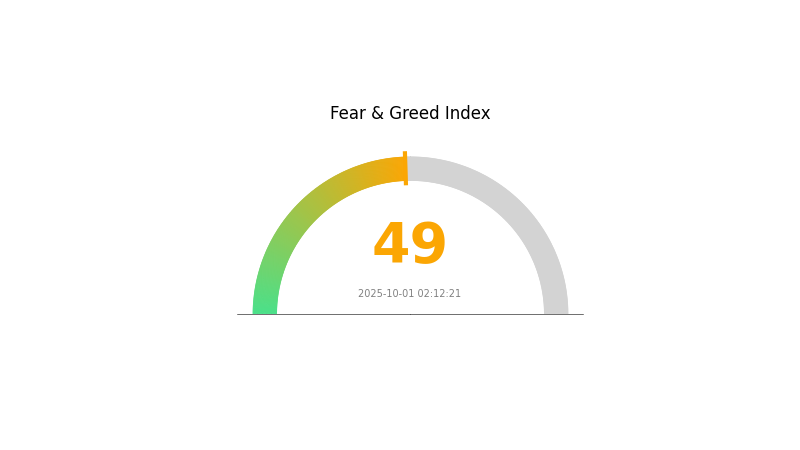

VELVET Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index hovering at 49, indicating a neutral stance. This equilibrium suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. It's a prime opportunity for traders to reassess their strategies and portfolios. While the market lacks strong directional bias, it's essential to stay vigilant and monitor key indicators for potential shifts in sentiment. As always, diversification and risk management remain crucial in navigating the crypto landscape.

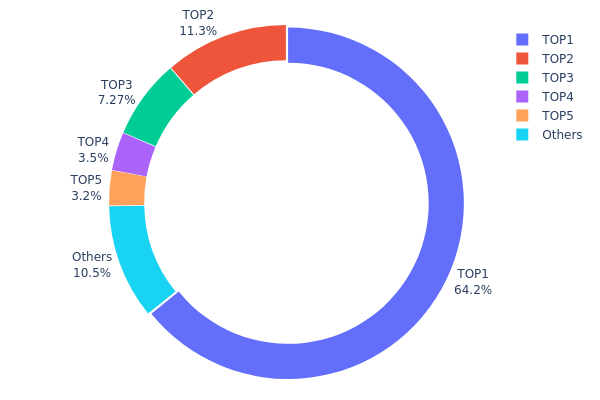

VELVET Holdings Distribution

The address holdings distribution data for VELVET reveals a highly concentrated ownership structure. The top address holds a significant 64.18% of the total supply, amounting to 641,861.07K tokens. This is followed by four other major holders, collectively accounting for an additional 25.28% of the supply. The remaining 10.54% is distributed among other addresses.

This concentration pattern raises concerns about the centralization of VELVET tokens. With nearly two-thirds of the supply controlled by a single address, there is a potential for market manipulation and increased volatility. The top five addresses together control 89.46% of the total supply, which could lead to significant price swings if any of these large holders decide to sell or move their holdings.

Such a concentrated distribution may impact market stability and could deter smaller investors due to the risk of sudden price movements. It also raises questions about the true decentralization of the project, as a small number of entities have substantial influence over the token's circulation and potentially its governance.

Click to view the current VELVET holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6e0b...bed395 | 641861.07K | 64.18% |

| 2 | 0xd19d...72b56c | 113237.91K | 11.32% |

| 3 | 0x6bff...f8f36a | 72666.67K | 7.26% |

| 4 | 0xcd57...3e14ee | 35000.00K | 3.50% |

| 5 | 0x93de...85d976 | 32000.00K | 3.20% |

| - | Others | 105234.35K | 10.54% |

II. Key Factors Affecting VELVET's Future Price

Supply Mechanism

- Token Distribution: The unlocking schedule and token distribution will continue to influence VELVET's price trend.

- Current Impact: Short-term price is more susceptible to market sentiment and macro liquidity fluctuations.

Technical Development and Ecosystem Building

- DeFi Integration: VELVET is focusing on emerging DeFi tool platforms and their integration with AI technologies.

- Ecosystem Applications: The project's development and trading activity levels will impact the token's price.

III. VELVET Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12303 - $0.16853

- Neutral prediction: $0.16853 - $0.20729

- Optimistic prediction: $0.20729 - $0.24605 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing momentum

- Price range forecast:

- 2027: $0.18331 - $0.36166

- 2028: $0.15844 - $0.42961

- Key catalysts: Project development milestones, market sentiment, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.36715 - $0.39101 (assuming steady market growth and project development)

- Optimistic scenario: $0.39101 - $0.41488 (with strong market performance and increased adoption)

- Transformative scenario: $0.41488 - $0.42961 (under extremely favorable market conditions and breakthrough developments)

- 2030-12-31: VELVET $0.41447 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.24605 | 0.16853 | 0.12303 | 0 |

| 2026 | 0.28814 | 0.20729 | 0.15754 | 23 |

| 2027 | 0.36166 | 0.24771 | 0.18331 | 46 |

| 2028 | 0.42961 | 0.30469 | 0.15844 | 80 |

| 2029 | 0.41488 | 0.36715 | 0.20927 | 117 |

| 2030 | 0.41447 | 0.39101 | 0.25807 | 132 |

IV. VELVET Professional Investment Strategies and Risk Management

VELVET Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in DeFi and AI integration

- Operation suggestions:

- Accumulate VELVET tokens during market dips

- Stake tokens to participate in governance and earn rewards

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Monitor Velvet's new partnerships and product updates

- Track user adoption metrics and trading volume on supported chains

VELVET Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holding

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for VELVET

VELVET Market Risks

- Volatility: DeFi tokens can experience significant price swings

- Competition: Emerging DeFAI projects may challenge Velvet's market position

- Liquidity: Lower trading volumes may impact ability to enter or exit positions

VELVET Regulatory Risks

- Uncertain regulations: Evolving DeFi regulations may impact Velvet's operations

- Cross-border compliance: Challenges in adhering to diverse international laws

- KYC/AML requirements: Potential implementation could affect user privacy

VELVET Technical Risks

- Smart contract vulnerabilities: Potential for exploits in Velvet's code

- Scalability issues: Challenges in handling increased user load across multiple chains

- AI integration complexities: Risks associated with AI decision-making in financial operations

VI. Conclusion and Action Recommendations

VELVET Investment Value Assessment

VELVET shows promise in the DeFAI sector with its multi-chain presence and AI integration. However, investors should be aware of the high volatility and regulatory uncertainties in the DeFi space.

VELVET Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and AI integration ✅ Experienced investors: Consider allocating as part of a diversified DeFi portfolio ✅ Institutional investors: Evaluate VELVET as part of a broader DeFi and AI investment strategy

VELVET Trading Participation Methods

- Spot trading: Purchase VELVET tokens on Gate.com

- DeFi participation: Engage with Velvet's DeFi strategies on supported chains

- Staking: Participate in potential staking programs for passive income

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is velvet crypto?

Velvet is a Web3 cryptocurrency built on the Solana blockchain, known for fast and low-cost transactions. It operates in the decentralized finance ecosystem with the ticker VELVET.

What is the price prediction for Coti in 2050?

Based on a 5% annual growth rate, Coti's price is predicted to reach $0.1518 by 2050. This long-term forecast assumes steady market growth and adoption of the Coti network.

What is the market cap of velvet?

As of 2025-10-01, the market cap of Velvet is not publicly available. The latest data on Velvet's total market value is currently unknown or undisclosed.

What is the price prediction for $vet?

VET is predicted to trade between $0.021 and $0.029 in 2026, with a potential increase of 32% from current levels.

Share

Content