XRP Price Prediction: XRP Could Rally 50% – 60% in October With ETF Inflows Targeting $4.5

Sustained Inflow of Institutional Capital

Recent data from the Chicago Mercantile Exchange (CME) shows that XRP futures have become the fastest product to surpass $1 billion in open interest. Over the past four months, trading volume has reached $1.8 billion, equivalent to 6 billion XRP—about 6% of the total supply. This underscores that institutional capital has moved in early, setting the stage for future market developments.

ETF Inflows Could Reach $20 Billion

Market consensus holds that ETFs will unleash a significant wave of capital. JPMorgan projects first-year inflows of roughly $4–8 billion, while Canary Capital anticipates up to $5 billion could pour in during the first month alone. Analyst Zach Rector, referencing futures data, suggests that inflows could reach $10–20 billion in the first year—potentially transforming the entire market structure for XRP.

Retirement and 401(k) Funds as Catalysts

Beyond Wall Street, ETFs are expected to draw long-term investments from 401(k) plans and pension funds. These investors seek stable, long-term holdings rather than short-term gains, providing a more reliable demand base. As multi-trillion-dollar pension assets begin to allocate to XRP, its market capitalization and strategic position could see significant reinforcement.

Short-Term Price Outlook

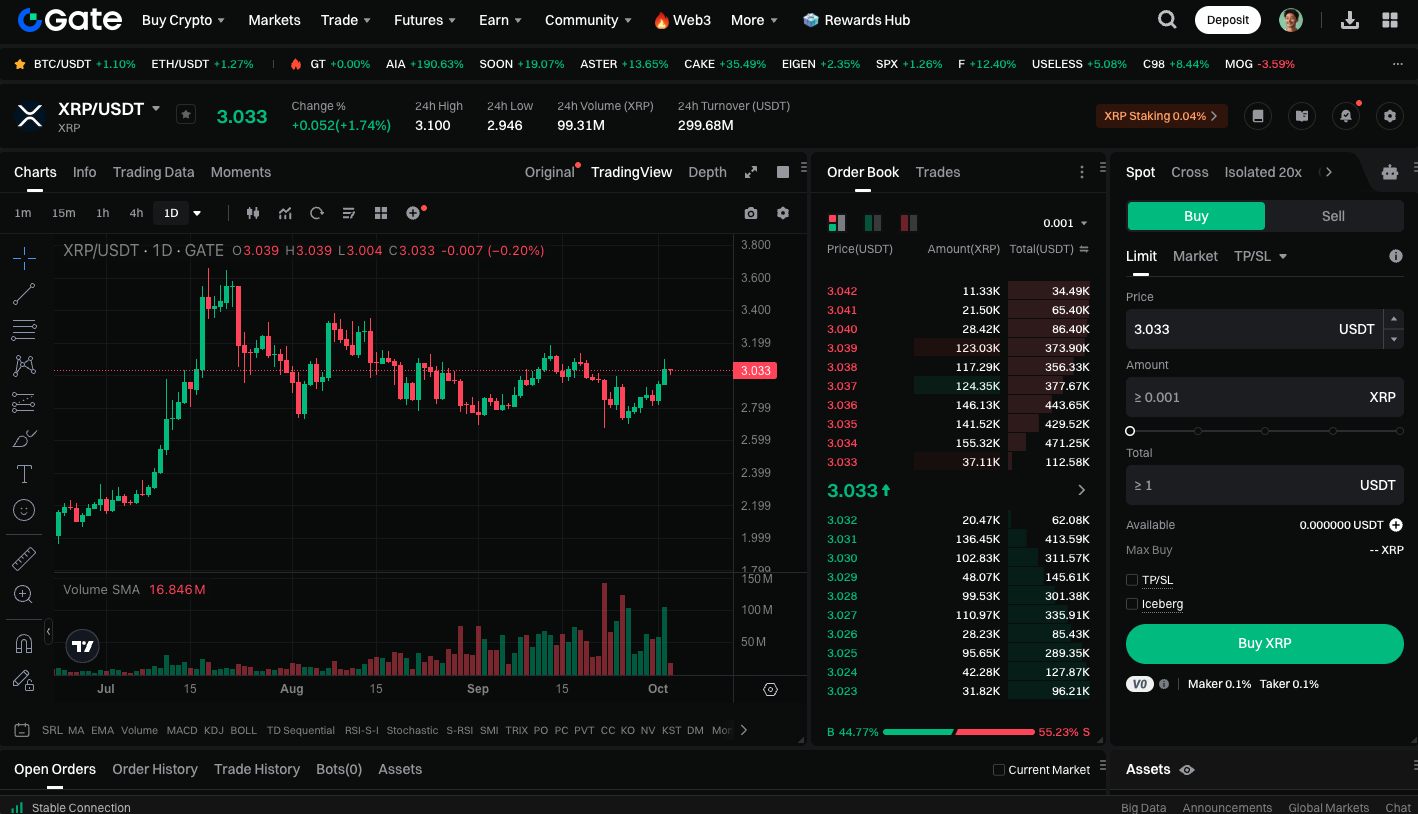

With XRP firmly above $3, market attention is now on the ETF decision anticipated in October. Most analysts agree that approval could propel XRP rapidly toward $4 and test the $4.5 resistance level—representing a short-term upside of 50%–60% from current prices. While the initial rally may not breach $5, simultaneous approval of multiple ETFs could spark a more prolonged uptrend.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Summary

XRP stands out for its dual advantages—real-world payment applications and growing institutional adoption. Should ETF inflows reach the multi-billion dollar threshold, XRP will no longer be a niche altcoin, but an essential asset for both institutional and retail investors. Looking ahead, some analysts predict XRP could reach $19–$26 by 2030, highlighting its robust long-term potential.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Sell Pi Coin: A Beginner's Guide

Understand Baby doge coin in one article